Snowy Mountains Centennial Plaza Sells for $13.725 million

Broadcasted 17 April 2025 by 7 News ACT

Snowy Mountains Centennial Plaza Sells for $13.725 million

Broadcasted 17 April 2025 by 7 News ACT

Snowy Mountains shopping centre sells for $13.7 million

Cooma’s Centennial Plaza, a Coles-anchored shopping mall in the Snowy Mountains, has been sold to Brisbane-based syndicator Natgen Group.

The $13.725 million deal was brokered by global commercial real estate and investment management company JLL.

“In 2024, neighbourhood centre transactions in Regional NSW increased by 22 per cent based on the previous year, clearly showcasing the demand from investors for regional NSW assets outside of the tightly held Sydney market,” said Sebastian Fahey, JLL senior executive, retail investments NSW.

The plaza, previously owned by Adelaide-based FRP Capital, has 4395sqm of gross lettable area and includes a Coles supermarket, two office tenancies and 13 specialty shops.

“The centre’s strong tenancy profile and strategic positioning within the Snowy Mountains corridor presents a compelling long-term investment opportunity,” said Steven Goakes, MD of Natgen.

Article by Inside Retail

Article source

Cooma’s Centennial Plaza, a prominent Coles-anchored neighbourhood shopping centre in the Snowy Mountains, has sold for $13.725 million to a Brisbane-based syndicator.

JLL’s Sebastian Fahey and David Mahood brokered the sale. The deal was concluded post the close of the Expressions of Interest (EOI) campaign and was sold by Adelaide based syndicator FRP Capital and purchased by Brisbane based syndicator Nat Gen.

Sebastian Fahey, JLL Senior Executive, Retail Investments – NSW commented on the transaction: “The sale of Centennial Plaza confirms the ongoing demand for well-positioned, supermarket-anchored centres in regional locations within NSW. In 2024, neighbourhood centre transactions in Regional NSW increased by 22% based on the previous year, clearly showcasing the demand from investors for regional NSW assets outside of the tightly held Sydney market.”

Centennial Plaza, located at 116-128 Sharp Street in Cooma, spans 4,395sqm of gross lettable area (GLA), comprising a Coles supermarket, 13 specialty shops and two office tenancies. Its diverse tenant mix and strong anchor covenant proved attractive to investors seeking stable income streams in regional markets.

David Mahood, JLL Senior Executive, Retail Investments – NSW, added: “Looking ahead, we anticipate this demand to persist, especially for assets that offer a blend of stable income and potential for future growth. The ongoing infrastructure investments in regions like the Snowy Mountains are likely to further enhance the appeal of strategically positioned retail assets in these areas and continue to attract strong investor interest.”

Steven Goakes, Managing Director of Natgen stated “The acquisition of Centennial Plaza aligns with Natgen’s investment philosophy of targeting defensive, supermarket-anchored assets in growth regional locations. The centre’s strong tenancy profile and strategic positioning within the Snowy Mountains corridor presents a compelling long-term investment opportunity. We continue to see value — as do our investor clients — in well-located regional convenience centres that offer income resilience and the potential for sustainable capital growth.”

Article by Commo.

Article source

Natgen exists to provide our clients with well-considered, risk-managed investment opportunities and quality strategic advice. We base our decision-making, advice and investment offers on careful measurement and analysis, and combine this with our management experience to arrive at quality solutions.

1,400+ followers

NatGen in 2025, busy times.

As we pass the quarter post of 2025, the NatGen team is intensely focused and fully occupied.

It is now five years since the beginning of the COVID-19 pandemic.

And it is fair to say that this one event has dominated the economic landscape ever since,

perhaps at least until a certain inauguration ceremony

in Washington DC in January this year.

In this five year period,

we have become familiar with almost constant economic change.

Quarter one of 2025 has been no exception.

Whilst this can be challenging at times, the good news is that we at NatGen are accustomed

to constant change within our markets and portfolio.

The outlook suddenly darkens.

With the recent announcement of a broad terrorist regime being implemented by the United States, the general outlook for global economies has been dominated by gloomy commentary.

Debt markets have responded to this

by factoring in reduced interest rates in the medium term,

consistent with the expectation of reduced global growth.

A comprehensive analysis of the impact of the US tariffs regime is well beyond the scope of this paper.

We can all consume copious analyses over the days and weeks ahead from a broad range of analysts.

My initial reaction, however,

is to feel affirmed that we have stuck to the basics

when it comes to asset allocation

and a concentration on defensive property assets, where the provision of basic goods and services is the focus of our tenants.

I believe that this has shielded us

from some of the price variability

in certain markets over the past five years and is likely to continue to do so in the future.

Of course, anyone invested in the share market currently is familiar with price variability.

The current times provide a salutary contrast between share price variability and the relative stability of property assets

and income production.

We see this as a major benefit

of commercial property investment.

Debt capital management and interest rate management.

Even prior to the recent tariffs revelations, medium-term market interest rates have been moderating.

As I have mentioned previously to you, NATGEN keeps a constant watch on interest rate projections and market pricing over the terms of our trusts.

This is the basis upon which we formulate a view on the average five-year interest rate over the term of a NATGEN investment trust, as stated in our information memoranda.

As the medium-term rates have modified, we have taken the opportunity to hedge our interest rate positions on a number of trusts, including CO24, QC24,

SP24 and CA25, and also to seek reduced margin arrangements with banks on other trust debt, including GD21, IR22 and GL22.

This activity has produced meaningful reductions in interest rate costs of virtually all of the trusts mentioned above. The aim of interest rate hedging is to limit the risk posed by interest rate variability on the performance of the trust by fixing the interest cost for a certain term.

In the case of our recent hedging,

we have been focusing on three-year fixed terms, as this provides the best rates along the forward interest rate curve.

Consistent with our current defensive positioning, we will be proposing to maintain current distribution levels and bank any savings for the maintenance

of appropriate capital buffers for the trusts.

Of course, any surplus not distributed now will add to the capital base of the trust when it comes to an end, and trust assets are distributed to unit holders.

The NATGEN response.

Consistent with the NATGEN investment philosophy, we continue to seek assets which provide long-term defensive income and to acquire at prices which reflect solid value in the medium term.

We seek to take advantage of the inefficiencies in the property market

to target mispriced assets.

Within this context, we continue to set target sectors based on our assessment of value.

The following synopsis of our target areas outlines the value propositions we seek.

Regional convenience retailing.

Well-placed assets within solid regional locations provide steady income consistent with our aims,

but generally at more favorable prices than metropolitan assets.

Historical data indicates that approximately 30% of the nation’s GDP is derived in regional Australia.

This figure underscores the significant economic role of regional Australia, whilst also producing the majority of the nation’s merchandise exports.

Recently, the secret appears to be out, and competition to acquire these assets is increasing.

Examples of NATGEN trusts relying on regional convenience retail include KT-21, GD-21, IR-22, CO-24, and CA-25.

Non-CBD Office.

The CBD office sector was slammed during the pandemic

due to stay-at-home mandates and the like.

Work-from-home protocols emptied city office buildings.

The whole sector has experienced downward value pressure, leading to value purchasing opportunities.

Concurrently, steep rises in construction costs have made replacement of office stock unviable at current rental levels,

providing existing buildings with a significant competitive rental advantage, especially in tightly held precincts.

NATGEN examples of non-CBD Office assets include GL-22 and QC-24, with another coming soon.

Value-add industrial. Industrial property across the globe has benefited from the stampede to internet shopping during the pandemic and thereafter.

This has focused principally on logistics and fulfillment.

However, much of the traditional industrial stock is focused on manufacturing and its supply chain.

This traditional industrial stock is transitioning to more modern industrial forms, with the attendant uplift in values as the repositioning occurs.

NATGEN remains aware of this trend and vigilant for opportunities in this market.

We hope to provide you with an example of this type of investment later in 2025.

Specialist assets.

Specialist assets are identified by their strong income generation attributes and sustainability of these income streams.

Again, we look to certain sectors that offer certainty in times of volatility, such as medical and logistics support.

Tenants in these fields tend to have strong income generation linked to government spend,

essential services, or blue-chip clientele.

And NATGEN example of this is SP24.

NATGEN developments in 2025.

NATGEN is set to deliver five development projects in 2025,

with a total value in excess of $110 million.

In all cases, the developments are being delivered within the initially assessed cost envelopes for each project.

This has been an amazing effort by the NATGEN development team.

The pipeline will continue to grow in 2025, with a NATGEN Development Trust release imminent.

Whilst the sector focus of our development projects will broaden in 2025,

the fundamentals which we seek will remain unchanged.

These include a proven market, good value sales expectations, and strong cost control.

Focusing on the basics.

Beyond acquisition strategy and development delivery,

we at NATGEN remain focused on delivery of the basic fund management and property management services,

upon which our unit holders rely.

Words which we aspire to embrace are care, dependability, innovation, and transparency.

We look forward to providing you with new opportunities in both NATGEN Development Trusts and NATGEN Investment Trusts in the coming weeks.

Thank you for your time, Steven Goakes.

Kingsthorpe shopping centre nears full tenancy after major investment boost A neighbourhood shopping centre in...

Kingsthorpe shopping centre nears full tenancy after major investment boost A neighbourhood shopping centre in...

New $100m self-storage facility opens on former Molendinar factory site The Gold Coast’s shrinking living...

Keeping store and order A $100m self-storage centre has replaced the former site of a...

Natgen exists to provide our clients with well-considered, risk-managed investment opportunities and quality strategic advice. We base our decision-making, advice and investment offers on careful measurement and analysis, and combine this with our management experience to arrive at quality solutions.

Peta brings over 25 years’ financial service experience gained in funds management, and wealth management. As a top performing fund manager, Peta managed institutional cash and fixed income portfolios (in excess of $5b) for Suncorp Investments, and as an Executive Leader, led ASX listed Cromwell Property Group’s Retail Funds Management business. At Natgen, Peta provides our funds management business with further depth and leads the development of new Natgen investments for the

benefit of our Unitholders.

Steve has had a varied career at the ABC from researcher for 7.30 Report to producing Stateline, as well as ABC Radio news and presenting the Queensland Statewide Evenings radio program.

Steve’s love of Brisbane and passion for fighting the good fight ensures lively and informative conversation every morning on ABC Brisbane.

ABC Radio Brisbane. 13.5 to 9, believe it or not, there will probably be some benefit for

Queensland as a result of the Trump tariff moves. So how will this affect residents in the state?

Peta Tilse is Head of Funds Management at NatGen. I spoke to Peta Tilse early this morning

and observed that the stock market or the share market has taken a hammering.

Yeah, morning Steve. Look, all of us have superannuation,

accounts, all of those ask that work, etc. And so if you actually had a look at your account today,

it’s probably looking a bit dusty after being battered last week and yesterday. Having said that,

if you do have some cash on the sidelines, I mean, some of these super funds have been sort of taking

money out of shares in recent times because they’ve been overvalued. Well, they’re probably just

redeploying and yeah, so they’re probably just redeploying and putting more capital to work.

The other side of things too is we’ve seen the Australian dollar that absolutely got hammered

yesterday and in fact this morning, it’s still trading under 60 cents US. That’s actually really

good for our exporters. And inbound tourism as well, I understand. Correct. And it’s great

for our exporters. It also makes, it pretty much negates whatever tariff he’s just put on us.

So it’s actually making us more competitive globally. So that’s actually positive.

And then in terms of interest rates, because for those of us that have mortgages,

there’s actually more forecasts of interest rate cuts. Now they’re actually talking that in May,

we might get 50 basis points as a cut. ANZ, which has been probably one of the banks,

the majors that only thought one interest rate cut this year about a week ago. And

NAB on the other side was always expecting three. ANZ is now saying three interest rate cuts this

year. So that will bring our cash rate down to 3.35 cents. So that’s a lot lower than where we are

now at 4.1. So that will help mortgages. And yeah, and so those sorts of things will filter through

to us everyday people. My guest is Peta Tilse. She’s head of funds management at NatGen.

This is 612 ABC Brisbane. So an Aussie dollar around 60 cents US is good for our exports,

which would be good for mining and the agricultural, our farmers. It’ll be great for inbound tourism,

which should look after Queensland somewhat. It’ll slow Australians going overseas and spending

their money overseas are more likely to spend it here. In a sense, it’s sort of an irony, isn’t it?

The Donald Trump’s wild move looks like it’s killed off Peter Dutton’s prime ministerial

ambitions and it’s helped Anthony Albanese, who has been, what’s the word? Less than complimentary.

Doing a Stephen Bradbury. Thank you. So Albo’s doing a Stephen Bradbury. And of course Brent

Crude. The price of Brent Crude went down significantly as well, which will also make our

petrol significantly cheaper once the oil companies pass it through. So and that’s all to do with the

everyone’s sort of worried about what they’re calling now an economic nuclear winter. Like that’s

so dark, right? So that’s that’s sort of how they’re describing what’s what’s going to happen in the

States. But you’ve got to remember, we’re talking about two of the world’s largest economies,

which are the US and China. And if those two slow down in growth in terms of what they’re doing,

that means less demand from everybody else, what we export to those particular countries. And

whilst in the states, they’ve got a trade surplus with us, we import more from the states than we

export to them. In China, it’s not not the case. And, you know, more than a third of our exports

go to China. And so there will be kind of repercussions, I guess, in the sense that demand

will drop off. But that Australian dollar being quite soft is actually in our favour.

Isn’t that ironic? This is 612 ABC Brisbane, my guest is Peta Tilse. Peta, given what’s happened

in the United States, and there’s some rumblings about a possible recession, what does this mean for

property or house prices at all, where people, a lot of people have invested

in different areas of the property market. What do you see?

So there’s still going to be demand, Steve, because we still haven’t solved the housing crisis in

Australia. You know, the beauty of property is it’s all always bricks and mortar. It’s an asset

that will always be there for people. So I don’t think property prices are going to go down anytime

soon. And in fact, when interest rates do come lower, it sort of makes things a bit more affordable.

So it probably supports property valuations. Now, let me play you what Michael Knox, chief

economist at Morgan’s told me a couple of days ago. His argument is that we’re slightly misunderstanding

the Trump tariff. It’s not a protection move. It’s a negotiation or a trading move.

So this is not a conventional tariff war. This is an invitation to bargain and enter a bargain

for lower tariffs. So if, for example, China cut its tariffs in half, the US would cut its tariffs

in half in return. So it is, as I say, amazingly, in the case of Donald Trump, it is the beginning

of a bargaining process. That’s Michael Knox from Morgan’s. So have any countries indicated at all

that they are prepared to start talking or trading their tariffs? Well, the word is, Steve, that

over the weekend about 50 countries turned up on the US doorsteps. So they’re ready to make deals,

I believe, Israel, some of the smaller Asian countries. Vietnam, I believe. Yep. They’re all

over there ready to cut a deal. So in the scheme of things, he’s begun what he probably set out to do.

So now as an unexpected result from this, does this mean that Donald Trump’s wild move

will actually assist lower inflation in Australia? Is that what’s slowly starting to appear?

That this will actually force inflation down? They will put the recession question to one side,

but will actually lower inflation in Australia, Peta Tilse?

I guess it depends on what’s used. So, excuse me, in terms of, you know, if we’re aligned on

imports for certain major projects and things like that, well, you know, that’s going to be more

expensive. But it just, yeah, it just kind of depends. It’s not going to solve our energy

issues internally, which means we can’t really be out there manufacturing to compete for anything here.

But we can still pull out of the ground more iron ore and we can still pull, you know, get

more beef off the land, so to speak. We can do all those things, but it’s not changing our

cost of production internally at this stage because we still have various wage costs and

other factors of production, you know, cost of production.

Peta Tilse, thanks very much for your time once again.

Pleasure, Steve.

Peta Tilse, she’s head of funds management at NatGen.

Kingsthorpe shopping centre nears full tenancy after major investment boost A neighbourhood shopping centre in...

Kingsthorpe shopping centre nears full tenancy after major investment boost A neighbourhood shopping centre in...

New $100m self-storage facility opens on former Molendinar factory site The Gold Coast’s shrinking living...

Keeping store and order A $100m self-storage centre has replaced the former site of a...

Natgen exists to provide our clients with well-considered, risk-managed investment opportunities and quality strategic advice. We base our decision-making, advice and investment offers on careful measurement and analysis, and combine this with our management experience to arrive at quality solutions.

Peta brings over 25 years’ financial service experience gained in funds management, and wealth management. As a top performing fund manager, Peta managed institutional cash and fixed income portfolios (in excess of $5b) for Suncorp Investments, and as an Executive Leader, led ASX listed Cromwell Property Group’s Retail Funds Management business. At Natgen, Peta provides our funds management business with further depth and leads the development of new Natgen investments for the

benefit of our Unitholders.

Steve has had a varied career at the ABC from researcher for 7.30 Report to producing Stateline, as well as ABC Radio news and presenting the Queensland Statewide Evenings radio program.

Steve’s love of Brisbane and passion for fighting the good fight ensures lively and informative conversation every morning on ABC Brisbane.

You’re listening to Mornings on ABC Radio Brisbane with Steve Austin.

The Reserve Bank of Australia made its cash rate decision yesterday.

It didn’t budge.

It’s clear.

It’s not straightforward as to whether inflation is actually beaten or not, although it does

look like it’s moderated according to the Reserve Bank, but they’re not confident of

the direction it’s yet to go.

So what does this reveal about the federal government’s policy settings?

Well, let’s go to Peta Tilse.

Peta Tilse is head of funds management at NatGen.

I spoke to her earlier this morning.

Steve, they didn’t even discuss any sort of cuts or anything like that this time round.

They still noted the tight labor market.

They noted that activity is picking up.

They also noted that productivity is flat.

So none of those things would ever suggest a further rate gap, to be honest.

So it kind of brings back into question what happened back in February, I would suggest.

What happened back in February?

Where they dropped it?

Where they dropped it, yeah, which really felt like Michelle Bullock was pressured into

it, because that was kind of the feeling from most in the market.

In the statement I read from Michelle Bullock, it’s quite clear to them that the RBA, it’s

not clear to the RBA which way inflation is going to go.

What does that say about the current Albertese government’s policy settings?

Anything?

Well, just remember there’s two sort of, I mean, it’s not all about the RBA show for

Australia.

I mean, we have monetary policy, which is what they control, which is the supply of money,

which is interest rates.

And then on the flip side, we’ve got fiscal policy, which is what the government controls,

and that’s to do with spending.

And as we saw at the budget with Jim Chalmers, et cetera, they’re continuing to spend and

we’re going to have more debt, and that’s actually very stimulatory to an economy, which

is kind of putting the foot on the accelerator, so to speak.

Then this counterproductive problem, we’ve got one foot on the brake and one foot on

the accelerator.

Correct.

And we’re not really winging about interest rates being too high and trying to argue

for us, but you can’t have it both ways, I guess.

My guess is Peta Tilse, head of funds management at NatGen.

This is 612 ABC Brisbane.

What about then what we’ve heard from the opposition leader, Peter Dutton, he’s announced

that they’ll halve the federal fuel rebate for 12 months if elected.

Would that make any genuine dent in cost of living for people?

I actually think it will.

So if we look at the Albanese policy of cutting the tax ever so slightly to the point where

you get what is it, $5 a week or something like that, that doesn’t kick in until next

year.

So we’ve got 12 months to wait for that one, whereas this one will be instantaneous.

And what I like about it is that it’s not just for taxpayers, it’s for every person

in the economy.

And even if you don’t drive a car, even if you’re the pensioner that hops on the bus

and pays you 50 cent fare and off you go, you’re still going to benefit because when

you think about supply chains, when you think about going to the shops and buying your milk

bread, etc., that all has to get delivered or A produced and then B delivered to a shop.

So that will actually reduce the cost in that sort of part of the import.

And that will happen for everyone within Australia.

Well, that’s federal politics.

Let me ask you about something else that’s in my list’s minds and that’s housing.

So the RBA cash rate is of interest to people because what does it mean if you’re getting

a mortgage or you’re paying a mortgage?

How much is the value of a house risen in Brisbane over the last five years, Prita Tills?

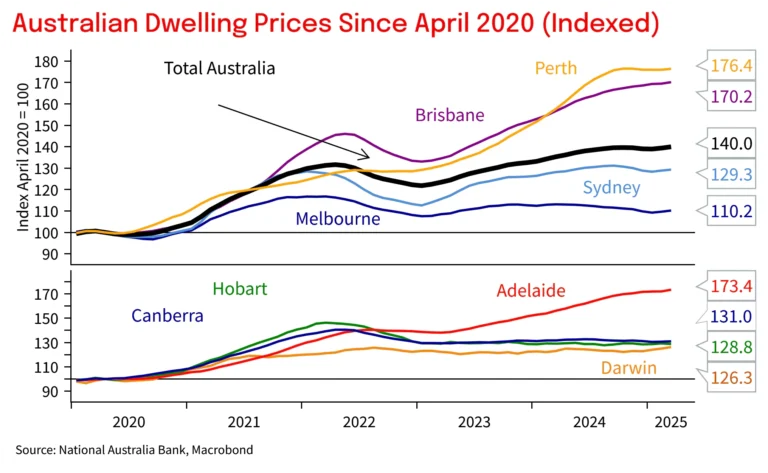

It is insane, Steve.

We had some data out yesterday and I was actually doing a pop quiz around the office to see

who thought which capital city had the highest sort of price rises over the last five years.

So this data is from April 2020 to now, so five years.

And if you think back to April 2020, it was sort of the middle of all the start of the

pandemic.

Okay.

So in terms of Brisbane, house prices have actually risen 70 per cent, seven zero.

So over five the last five years.

Yes, from then to now, that’s the measurement.

And in terms of which has gone up the most, it’s actually Perth, so they’re 76 per cent.

And who did the worst was actually Melbourne, unsurprisingly, 10 per cent.

If you own a house in Melbourne, it’s 10 per cent different from five years ago.

That’s how you interpret that data.

So if it was a million dollars, then it’s a 1,100,000 now sort of thing.

What world am I living in, Peta Tilse, if a cost of a house in Brisbane is greater than

the cost of a house in Melbourne?

What’s happened in the last five years?

Well, and it comes down to how an economy’s run.

This is literally it, right?

This is the crunch point.

And they had Dan Andrews lock everybody up.

They’ve got all sorts of problems, which they’ve just palmed off to Dysentralen.

And here we are with the amount and the debt in Victoria that the federal government or

whoever it is will probably have to help them along the way with some projects.

And so flip over to Queensland where we’ve got a mining sector that’s sort of kept everything

going for us, same with Perth.

And so they’re two of the strongest economies within Australia.

My guest is Peta Tilse.

She’s at NatGen.

She’s head of funds management.

We’re talking about the RBA decision and the cost of housing now.

Is are we in the housing bubble?

If the cost of a house in Brisbane or the value, sorry, of a house in Brisbane has increased

70% over the last five years, how is this not a bubble?

In my mind, bubbles pop.

How is this not a bubble?

Well, if we come back to economics, I’ll be boring.

And we look at supply and we look at demand.

Supply has not kept up with demand.

It’s quite simple.

And then therefore that impacts price.

Demand, don’t forget we, and some of the other data too that was released yesterday

shows the net interstate migration.

So remember, we had all those, as we call them, Mexicans, so to speak, coming over the

border to live in Queensland because it is quite cheap comparatively to other states

to live here.

And so Queensland still is leading the charge with net interstate migration.

So we’ve got, I think the number is, I don’t know, I think it’s like 28,000 people coming

in.

And conversely, we’re not building enough.

And what period of time is that 28,000 figure, Peta, tools?

I think that was the rolling quarter average.

Thank you.

So, yep.

And to be specific, anyway, so these people all need homes.

Then we’ve got also the fact that we’ve got net overseas migration.

Then we’ve also got the fact that people are still having babies and whatnot.

So population growth in Australia is about 115,000 people per quarter.

So if we’ve got that number of people coming into our country, they need to live somewhere.

And if we’re not building 115,000 houses per quarter, we’re just not kind of keeping

up with things.

That’s the supply, but also, sorry, that’s the demand, I apologize.

And conversely, the supply needs to sort of keep up with that.

So until that happens, we’re still in this kind of weird predicament.

Even in the commercial property world, so when we’re talking about shopping centers,

offices, et cetera, and this is sort of the world of nature and what we do, we just literally

settled on a shopping center for our investors on Monday.

And we’ve bought that 40% below the replacement cost.

So there’s a value in incumbent assets, like our assets that are already pre-built and whatnot.

And it means that for someone else to come in and build something that’s going to compete

with it, rents would have to be far higher.

So do rents go up?

Because it’s too expensive to build something here in Brisbane.

And so I had a quick look from a housing perspective.

So to build a house is anywhere from $3,000 to $5,500 a square meter.

And if the average size of a house is 226 square meters, we’re talking $633,000 as a

starting price to build a house.

Good grief.

So, yeah.

And then, like I don’t know about you, but I just got my rates, not my rates, my land

valuation notice.

Yes, I did as well.

Yep.

It’s up 20%.

Mine’s up 20%.

So, you know, it’s just incredible.

It hits you from every which direction, Steve.

Peta Tilse is an economist.

She’s head of funds management at NatGen.

Peta, I said on radio yesterday that in Brisbane you need to be a millionaire to own

an average home.

And a couple of listeners objected saying, well, you don’t need to because the bank will lend you money.

So I did a little exercise.

I went on artificial intelligence.

So I did what everyone else says you should do.

You’d have a mortgage of about $100,000 below the average mortgage, by the way, $510,000

at 4% interest, which is once again below the market rate over 25 years.

And you end up paying over $2,600,000 for an average house.

And I’m just thinking…

Incredible.

How is this not madness?

How is this not madness?

I mean, at some point something’s going to break.

Yeah.

And I think, you know, maybe it’s, maybe it’s a, we’re at a juncture where we give away

that sort of Australian dream of owning your own home.

And maybe it’s your renting your own home, which is the sort of more European model.

So, you know, maybe that’s where we’re getting to.

Peta Tilse, thank you very much for your time.

Cheers, Steve.

Peta Tilse, Head of Funds Management at NatGen.

Kingsthorpe shopping centre nears full tenancy after major investment boost A neighbourhood shopping centre in...

Kingsthorpe shopping centre nears full tenancy after major investment boost A neighbourhood shopping centre in...

New $100m self-storage facility opens on former Molendinar factory site The Gold Coast’s shrinking living...

Keeping store and order A $100m self-storage centre has replaced the former site of a...

Cooma Centennial Plaza set for official handover

COOMA’s Centennial Plaza will soon be in the hands of Australian property fund manager Natgen, following the completion of a due diligence process on the plaza. Centennial Plaza is one of the region’s largest retail precincts and by the end of March, will be owned by Natgen.

Natgen secured the Coles anchored retail centre in mid-December 2024 and has since undertaken detailed assessments to ensure a thorough understanding of the asset’s condition, operations and future potential. “The Natgen due diligence process involves both external experts and our in-house team to assess everything from building structure and operational aspects to leasing requirements and opportunities,” Natgen managing director, Steven Goakes, said.

As a commercial property fund manager, Natgen identifies, negotiates, and acquires assets like Centennial Plaza through a trust structure, providing investors with an opportunity to own a share of the asset and diversify their portfolios. The trust is managed over a term of approximately five years, offering investors a projected annual income return of around eight per cent from leasing revenue. “This is why due diligence is critical,” Mr Goakes said. “It validates investment assumptions and lays the groundwork for optimising the active management of the asset.”

With the process now complete, Natgen has officially gone to contract with the vendor and will take over management of Centennial Plaza at the end of March. Located on Sharp St, Cooma, Centennial Plaza is home to a full-line Coles supermarket, 15 retail and essential service tenancies including The Reject Shop, Commonwealth Bank, and Bendigo Bank, as well as the only Tesla Superchargers in the region.

With dual street access and substantial parking for 210 cars, the centre serves as both a critical local hub and a key stop for the 2.7 million tourists travelling through the Snowy Mountains annually. Natgen acquired the centre for $13.725 million.

Article by The Monaro Post

Article source

Australia’s healthcare system is under mounting pressure, with chronic underfunding struggling to keep pace with shifting demographics.

While federal and state governments spent $175bn on healthcare (around 70 per cent of total health expenses) last financial year, and both major parties have promised $8.5bn extra for Medicare, demand continues to outstrip supply.

Increasingly, private investment is filling the gap. Driving this shift is our ageing population. The over- 65 cohort makes up 17 per cent of the population but accounts for 40 per cent of public hospital care and nearly 50 per cent of hospital bed occupancy.

By 2063, the over-55s group could nearly double, from 7.7 million to 15.2 million people. As chronic conditions like cancer become more prevalent, demand for specialised healthcare services is intensifying.

South East Queensland – particularly the Gold Coast – is a prime location for healthcare property investment, due to its strong population growth and ageing demographics. The city exemplifies the challenges of rapid population growth and the need for innovative healthcare solutions.

However, government investment has struggled to keep pace, leading to capacity constraints in public healthcare.

This has driven the rise of alternative healthcare models, such as specialist day hospitals, which alleviate pressure on major hospitals while ensuring critical treatment access.

Natgen’s Investment Trust SP24, is an example. Its key asset, Icon Cancer Centre provides high-quality cancer treatment in a dedicated setting, improving patient outcomes and freeing up resources in overstretched public hospitals. This shows how private capital can deliver real solutions to meet growing healthcare needs.

With government budgets stretched thin, public-private partnerships and private capital investment are becoming essential to delivering healthcare infrastructure. Medical property assets such as specialist medical centres, private hospitals and diagnostic facilities are attracting strong interest from investors due to their stable, long-term income streams and resilience. Healthcare is an area where ethical investment aligns with strong financial fundamentals. Private capital is ready to support essential healthcare infrastructure, while delivering sustainable returns to investors.

Steven Goakes is the managing director of Natgen.

Article by The Courier Mail

Written by Steven Goakes

Article source

Natgen exists to provide our clients with well-considered, risk-managed investment opportunities and quality strategic advice. We base our decision-making, advice and investment offers on careful measurement and analysis, and combine this with our management experience to arrive at quality solutions.

Peta brings over 25 years’ financial service experience gained in funds management, and wealth management. As a top performing fund manager, Peta managed institutional cash and fixed income portfolios (in excess of $5b) for Suncorp Investments, and as an Executive Leader, led ASX listed Cromwell Property Group’s Retail Funds Management business. At Natgen, Peta provides our funds management business with further depth and leads the development of new Natgen investments for the

benefit of our Unitholders.

Steve has had a varied career at the ABC from researcher for 7.30 Report to producing Stateline, as well as ABC Radio news and presenting the Queensland Statewide Evenings radio program.

Steve’s love of Brisbane and passion for fighting the good fight ensures lively and informative conversation every morning on ABC Brisbane.

So will this mean your groceries will be more affordable,

that energy costs will go down,

that house prices will go down,

the heat will come out of the inflated market,

or that your rent will go down?

Let’s go to Peta Tilse.

Peta Tilse is head of funds management at NatGen.

I spoke with Peta Tilse this morning

and asked her to explain what’s happening

when it comes to the cash rate decision

and all the big four banks jumping on board

saying, oh, we’re instantly doing what the RBA

has set the standard for.

I would describe it, Steve, as like breaking a diet.

So imagine you’ve been working so hard at this diet,

you’ve lost the weight,

and then you go to this particular party,

you’re a bit nervous about going to this party,

and then all of a sudden at the very end of the night,

you’ve been good all night,

and you’re around the table

and there’s a big, fat birthday cake there,

and everyone’s saying, oh, and have a bit, have a bit.

And it’s just that, you know, you do eat that bit,

and then you eat more, and then you eat more.

And the thing is, you know, we’ve come such a long way,

and we didn’t need to cut interest rates yesterday.

We could, and we did, but we didn’t need to.

And now the risk is that you’ve blown the diet

and that could actually,

it could actually transpire into something a bit worse.

Right, okay.

So let me hit you with some rapid-fire questions.

Has inflation been defeated, Peta Tilse ?

It’s tamed for the moment, but not defeated,

because we’re still above, the trimmed mean,

the reserve bank’s preferred measure,

we are still above 3%.

Will my shopping be more affordable now?

Prices won’t be going backwards.

I can’t see that happening.

Will energy costs go down?

Electricity, things like that, will that go down?

I think there’s bigger things that need to happen there.

This won’t change anything.

Will my insurance go down?

It’s gone up nearly 20% to 30% for some people.

Will that go down?

Definitely not.

Will my rent or house prices go down?

Prices, no.

Demand will just only increase,

because this actually makes it more affordable

for some people.

So then why the rate cut?

The whole point of a rate cut is to get the burden off Australia.

It’s given what you’ve told me, Peta Tilse, from NatGen.

Why the rate cut, given that it’s not going to send prices down?

Look, it’s…

To me, when you saw…

When you saw…

When you actually read the release, and when you…

This is the Reserve Bank of Australia release.

The Reserve Bank’s release,

I actually got this feeling that it was done with gritted teeth.

And then when you actually saw the governor speaking,

she literally was speaking through gritted teeth.

So it was like being like an economist

doing the right thing all the way through.

And I think she actually used some words

like there was rigorous debate or something like that.

So it wasn’t an easy decision,

and there must have been a couple of new players on that board

to make it persuasive.

But our economy…

Look, the growth is…

I’ve described it previously as anemic.

Inflation is getting toward that 2% to 3% band

on that trimmed mean measure, but we’re not there.

Wage prices are moderating, which is a good thing.

GDP…

Yeah, sorry, I’ve spoken about GDP.

But on the employment side of things,

where…

Employment’s going the other way.

Employment’s strong.

The unemployment rate is at 4%.

The reserve bank themselves were forecasting employment

to be 4.3%.

So the employment market is stronger than they’re expecting.

So you don’t have much slack in this economy,

so I just don’t get why you would have cut.

My guest is Peta Tilse.

Peta Tilse is head of funds management at NatGen.

This is 612 ABC Brisbane.

Peta, all big four banks in Australia pounced on it

and instantly said,

yes, we’ll pass this on instantly.

And by that, I think it means, anyway,

between the next two weeks and four weeks,

depending on how the bank is structured.

Does that indicate…

What does that indicate to you as an experienced economist

who watches these things when all…

Not just the big fours, some other ones, like ING and others,

said, yes, we’ll pass that on in full as well.

What does that say? Anything?

Well, I mean, they kind of have to,

because that’s your variable rate mortgage.

But also, that means for those that are savers

and have a little nest egg stashed away,

your term deposit rates will be lower too.

Now, heading into this meeting, Steve,

the market was pricing an 87% chance of this interest rate cut.

So it was pretty strong.

And just in terms of the forward-looking guesstimates,

I guess you could say, from the various banks,

NAB was probably one of the most aggressive forecasting,

a total of 100 basis points of interest rate cuts this year,

which sort of baffled me a bit,

but anyway, that was their call.

But ANZ were saying 50 basis points this year.

So I think ANZ is on the money

in terms of what they’re forecasting.

But when you read what the statement actually,

the press release, sorry, the monetary statement actually said,

the board remains cautious on prospects

for further policy easing.

So I think the NAB forecast could be pushed to the side.

And I don’t think Australians should be expecting more,

put it that way.

Okay, now I do happen to know that you won your office sweep

or your office bet that you picked it.

But what I’ve been interested to know is the supermarket.

It was very enlightening when you went to the supermarket

and did a comparison of when the sort of the prices

down campaign started some years ago

of the major Australian supermarket.

And you compared the actual,

the real shopping center supermarket.

Inflation rate and costs.

And it was anywhere between 15 to 40%

depending on what you were buying or more in some cases.

Even more, yeah, exactly.

Is this going to do anything to change?

To me, it looks, if you’ve got a mortgage,

if you’re the one in three Australians

that apparently has a mortgage,

it’ll give you a little bit extra cash every month,

but that’s about it.

Yeah, if you think about the average mortgage size

or even if we just use a round number,

if we say you’ve got $500,000 borrowed,

25 basis points to you means roughly $90 a month.

So that’s what you’re saving with this move.

But don’t forget the risk because like I said,

this employment market is pretty strong

and there’s not a lot of room to move.

The risk is that we’re back here in a few months time

and interest rates are going the other way

if we’ve gone too far, put it that way.

Peta Tilse is head of funds management with NatGen.

Peta Tilse, the real estate industry loved the announcement

and instantly sent our media releases

within about 30 seconds of the reserve bank announcement.

So they love it, but the market, the stock market

did not like it.

The ASX went down, the all-ordinaries finished lower.

What does that reveal?

Look, I think it’s what I’m saying is that

it’s about the outlook.

So stock markets look sort of 12 months forward

and they’ll be nervous about inflation,

you know, that this possibly wasn’t the right time to do it.

Like we just, I mean, we could have waited another one

or two meetings, but I don’t think that worked with the,

I guess the political pressure that’s around at the moment.

So no one in the market believes that inflation

is actually beaten and the picture I’m getting from you

is that people believe there’s a lot of politics in this RBA

or a lot of political pressure in this RBA decision.

Yes.

Will there be another rate cut this year, Peta Tilse?

Given that you won your office sweepstakes

or your office bet, what are you betting for this year?

Will there be any more?

The only, my only caveat this time around

would be whatever Trump does, right?

So he could pull a rabbit out of a hat.

I don’t think we will put it that way.

I think our employment conditions are too strong.

The fiscal spending is too much out there.

I think this is probably it.

And I don’t know, I guess you’ll play this back to me

in a few months time.

It’s on the line.

But yeah, so they…

Probably a one-off for this year.

Yes, I think so.

Peta, thanks for your time.

Pleasure, Steve.

Peta Tilse.

Peta Tilse is head of funds management at NatGen.

Kingsthorpe shopping centre nears full tenancy after major investment boost A neighbourhood shopping centre in...

Kingsthorpe shopping centre nears full tenancy after major investment boost A neighbourhood shopping centre in...

New $100m self-storage facility opens on former Molendinar factory site The Gold Coast’s shrinking living...

Keeping store and order A $100m self-storage centre has replaced the former site of a...

Natgen exists to provide our clients with well-considered, risk-managed investment opportunities and quality strategic advice. We base our decision-making, advice and investment offers on careful measurement and analysis, and combine this with our management experience to arrive at quality solutions.

Peta brings over 25 years’ financial service experience gained in funds management, and wealth management. As a top performing fund manager, Peta managed institutional cash and fixed income portfolios (in excess of $5b) for Suncorp Investments, and as an Executive Leader, led ASX listed Cromwell Property Group’s Retail Funds Management business. At Natgen, Peta provides our funds management business with further depth and leads the development of new Natgen investments for the benefit of our Unitholders.

Steve has had a varied career at the ABC from researcher for 7.30 Report to producing Stateline, as well as ABC Radio news and presenting the Queensland Statewide Evenings radio program.Steve’s love of Brisbane and passion for fighting the good fight ensures lively and informative conversation every morning on ABC Brisbane.

If you are wondering about what would appear to be almost optimism as a result in the aftermath

of the inflation data released yesterday, you’re not alone.

Many economists are going, well, yes, inflation has slowed reasonably.

That’s good news.

The Federal Treasury, Jim Chalmers, is right.

That’s good news.

Although many are questioning whether it’s under control.

The Reserve Bank will deliver its next interest rate decision on Tuesday, February 18.

And financial markets are apparently pricing in a more than 90% chance of a rate cut.

Now, if you hold a mortgage, that’s probably good news for you.

Let’s see what the RBA does next month.

However, if you’re living and you have to eat, pay insurance, pay rent, the situation

is actually not easing.

The data doesn’t reveal the real story.

As to why, let’s go to Peta Tilse.

Peta Tilse is a mother of three hungry boys and an economist.

And I spoke to her this morning about how she sees the latest inflation data.

So as we’ve all heard, the trimmed mean is 3.2%, which is great because it’s almost in

the 2% to 3% band that the Reserve Bank looks at.

And remember, the trimmed mean just shaves off the very volatile items on the side.

So we’re just looking at the sort of key stuff in the middle.

Having said all of that, when we look at what within the data were the biggest movers, and

I actually looked at it from the perspective of over the last 12 months, electricity prices

are down almost 10% over the last 12 months, which you would expect given all of those

rebates, right?

But without the rebates.

They are artificially brought down by the federal and the state rebates.

Correct.

And they’re not lasting.

So that was just that period of time.

So without those rebates, that number would have actually been positive 0.2% so up.

And then in terms of fuel, which was the other good one, that was down 2%.

That sure, that is what it is.

And that’s a good thing.

But that’s probably a bit of Trump blustering as well in terms of trying to get the fuel

price a bit lower to start Russia of money.

So that’s a whole other story.

And then if we have a look at other things, well, we all need insurance for our houses

and so forth.

Well, that’s up 5% over the year.

Fruit and vegetable prices up 7% over the year.

Rent up 6% over the year.

So it’s, you know, what’s actually happened is something you might have paid $100 for

a year ago is now $107 if it’s fruit and veg, for instance.

So that’s what’s happened.

Okay.

Now, I just thought it was interesting.

So I was curious before all of this, what prices of some everyday items that we might

have in our shelves at home.

I need to say at this point, Peta, it tells us that one of the reasons why I like speaking

with you is not only are you an economist, but you’re also the mother of three boys.

So you like myself and my listeners, you go to the supermarket and you shop yourself to

feed your family.

And that’s the reality check right there.

Absolutely.

So let’s, let’s, let, I did a bit of digging.

I found an old press release from Coles, one of the major supermarkets, and they were talking

about their prices are down campaign, which we’ll remember.

So they listed a bunch of everyday items that they were very proudly showing that they’re

going to keep at a low price.

This is back in September, 2020.

So the biggest mover I found was Moro Olive Oil.

It was $12 then.

Today it is $27 and on sale it is $19.

So the exact same like no shrink flation, that’s the price.

And so the percentage difference is 125%.

On sale it’s 58%.

So it’s nowhere near this trimmed mean of 3% right.

And then fab laundry powder, same kind of thing, $7 then $9 now.

So that’s 29% difference.

So an Nescafe, if you drink coffee, $10.75 to $14.50 now.

So that’s 35%.

So this is, this is the issue.

We used to pay nearly 35% less for certain items and we’re not.

And they’re going up incrementally and that’s what’s hitting the household budget.

What does this reveal, Peta?

Because at the moment, the sort of the economic commentary is that this is wonderful news

as a result of the inflation rate release yesterday.

It means that, you know, there’s a chance, there’s a chance of a rate cut in February

for mortgage owners.

But it’s sort of not really addressing what people are actually losing out of their

wallet on a weekly basis when they get food.

So what’s going on here?

Well, I think at the end of the day, look, we know that the politicians do what they

can and it is about with their iron the main prize, which is getting reelected.

And we did get those electricity rebates, which has helped bring down this particular

number that the Reserve Bank looks at.

But it’s temporary.

That’s correct.

And the everyday costs are still there.

Like we still will need insurance, fruit and veg, rent, the, you know, the big items

that have, like they’re slowing, like they’re slowing in terms of the price rises.

But, you know, it’s still elevated.

And it’s, like I said, those numbers keep growing off a higher base.

So it’s productivity.

It’s having cheaper access to energy to produce things.

It’s, it’s all of those things.

Jim Chalmers, the Australian Treasurer, says he’s confident that inflation is under control.

Do you agree?

I think, well, look, I think it’s better.

But I wouldn’t say it’s totally under control.

I think there’s a few, like I said, a bit of smoke and mirrors at play.

But if that’s what you have to do to get it down, sure.

But don’t forget, we don’t have a lot of slack in our economy.

And I mean, in terms of the employment situation, we’ve got an unemployment rate of 4%.

That is considered full employment.

Yeah.

So if we do cut rates, that’s going to be stimulatory.

That’s going to be positive for the economy.

That’s going to speed things up a little, which might mean you go to the shops a bit more or go out to dinner or whatever.

And that means that that business might hire another person.

But they’re trying to hire another person, which means prices of wages might go up.

You know, so it’s, it’s, it’s a, it’s a balancing act.

It’s, it’s, yeah, it’s difficult.

And there’s still a large amount of federal money going into the economy, particularly in the sort of the government sector with NDIS jobs and the like.

I think nearly half, well, nearly 500,000 people associated with the NDIS alone at the moment, all federal money, that that’s very stimulatory.

And perhaps some are arguing it’s distorting the economy.

That’s right.

And a lot of that, we saw that in the GDP numbers, the growth numbers.

Oh gosh, back in last month, how I think the, the rate was 0.8% was the annual growth rate, which is very slow, which is possibly a good thing.

But you would expect that unemployment would, would loosen up, so to speak, and move from that 4% rate to a bit higher, but it hasn’t.

So that’s where exactly what you said, like the government spending has actually sort of gobbled up some of these people and taken them out of what could have been other jobs or reduced a bit of slack in the economy.

I’ll let you go and plan for your shopping for the weekend as you feel the pain of, of the real

inflation. Peta Tilse, thanks very much for your time.

Pleasure, Steve.

Peta Tilse, she’s an economist as well as a mother of three hungry boys.

Kingsthorpe shopping centre nears full tenancy after major investment boost A neighbourhood shopping centre in...

Kingsthorpe shopping centre nears full tenancy after major investment boost A neighbourhood shopping centre in...

New $100m self-storage facility opens on former Molendinar factory site The Gold Coast’s shrinking living...

Keeping store and order A $100m self-storage centre has replaced the former site of a...

1,600+ followers