500+ followers

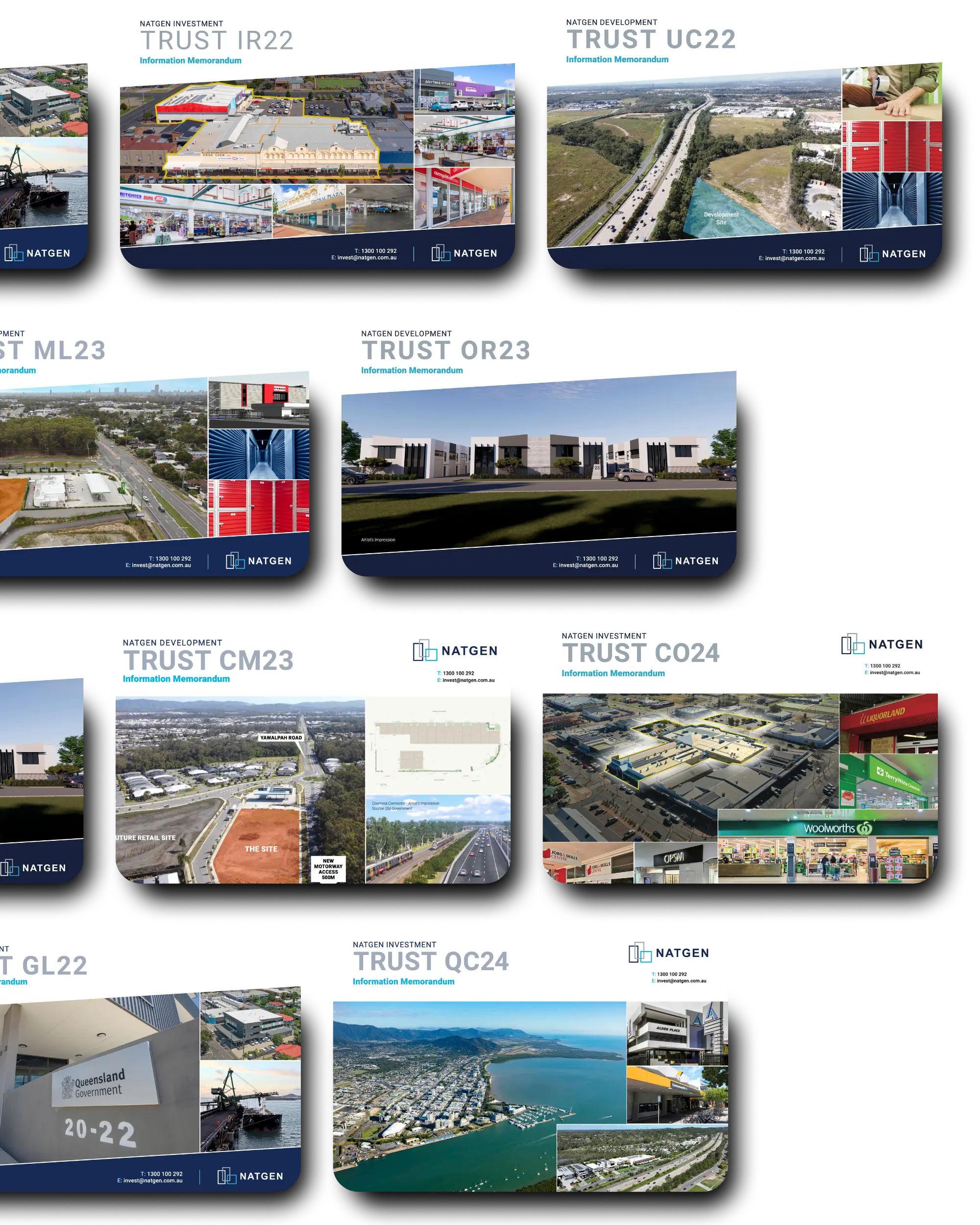

Natgen Investment Trusts are direct property trusts. These are also known as property funds, property syndicates, unlisted property trusts and property trusts.

As a Unitholder in a Natgen Investment Trust you become a part owner of large commercial property assets that may be out of reach of many investors to buy individually.

For as little as $100,000, you can invest in one or more commercial properties, such as office buildings, shopping centers, industrial warehouses, or specialty assets. Typically, your investment will be for a 5–6 year term.

FULLY SUBSCRIBED

Natgen Investment

Trust QC24

| $14.25 Million | |

| Tax Deferred Income | |

| Capital Growth Opportunity | |

| Office Commercial | |

| Established in 2024 | |

| 5-6 Year Term |

FULLY SUBSCRIBED

Natgen Investment

Trust CO24

| $10 Million | |

| Tax Deferred Income | |

| Capital Growth Opportunity | |

| Retail Commercial | |

| Established in 2024 | |

| 5-6 Year Term |

FULLY SUBSCRIBED

Natgen Investment

Trust GD21

| $10.1 Million | |

| Tax Deferred Income | |

| Capital Growth Opportunity | |

| Retail Commercial | |

| Established in 2021 | |

| 5-6 Year Term |

FULLY SUBSCRIBED

Natgen Investment

Trust GL22

| $9.28 Million | |

| Tax Deferred Income | |

| Capital Growth Opportunity | |

| Office Commercial | |

| Established in 2022 | |

| 5-6 Year Term |

FULLY SUBSCRIBED

Natgen Investment

Trust IR22

| $11.3 Million | |

| Tax Deferred Income | |

| Capital Growth Opportunity | |

| Retail Commercial | |

| Established in 2022 | |

| 5-6 Year Term |

FULLY SUBSCRIBED

Natgen Investment

Trust KT21

| $6 Million | |

| Tax Deferred Income | |

| Capital Growth Opportunity | |

| Retail Commercial | |

| Established in 2021 | |

| 5-6 Year Term |

- Monthly cash distributions – Stable income from the rents paid by the tenants of the properties

- Expert management – Properties are fully managed by Natgen and its property management company Realtec Services, including administration, maintenance, rent collection and leasing.

- Non-recourse borrowing – Due to our size and structure we can borrow on advantageous terms. The Financier will have no recourse to any Investor personally or to the other assets of any Investor.

- Taxation benefits – The Natgen trust structure allows investors to take advantage of the depreciation benefits available for commercial property, distributions will usually be fully or partially tax sheltered.

- Potential capital growth – As the value of the property grows the value of your investment will grow. At the close of a trust term, any capital profits that have been achieved over the life of the fund will be distributed to unitholders.

This is typically stated as an annual percentage return e.g., 8% p.a.

The income distributions will attract a tax advantaged component.

Any capital profits that have been achieved over the life of the fund will be distributed to unitholders.

The Natgen organisation has the skills, expertise, process and governance to provide a high quality investment and property management service to investors within its investment and development trusts.

Our trusts display the combination of the following attributes:

950+ followers