- Short term “develop and sell” trusts will typically have a 1-to-2-year term.

- Long term “develop and hold” trusts typically have a 5-to-8-year term.

1,000+ followers

Natgen Development Trusts provide investors with the opportunity to access the potential returns usually only available to large-scale property development groups.

Essentially, investors in the trust stand in the shoes of the property developer, only with the advantage of having the Natgen development team, with their experience and processes, by their side. We provide a complete development management service through the entire lifecycle of the trust, including site identification, risk managed site acquisition, planning and budgeting, project delivery and divestment of the finished product.

For a modest outlay, you can invest in a Natgen Development Trust, developing assets such as industrial warehouses, self storage facilities, retail showrooms or other specialty assets.

FULLY SUBSCRIBED

Natgen Development

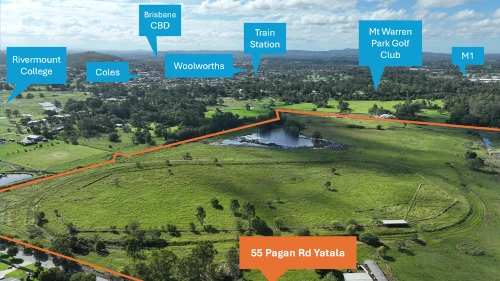

Trust RY25

| $5.2 Million | |

| Tax Deferred Income | |

| Development Profit | |

| Rural Residential Subdivision | |

| Established in 2025 | |

| 24 Months |

FULLY SUBSCRIBED

Natgen Development

Trust YB24

| $10.1 Million | |

| Tax Deferred Income | |

| Development Profit | |

| Industrial Warehouse Facilty | |

| Established in 2024 | |

| 18 - 24 Months |

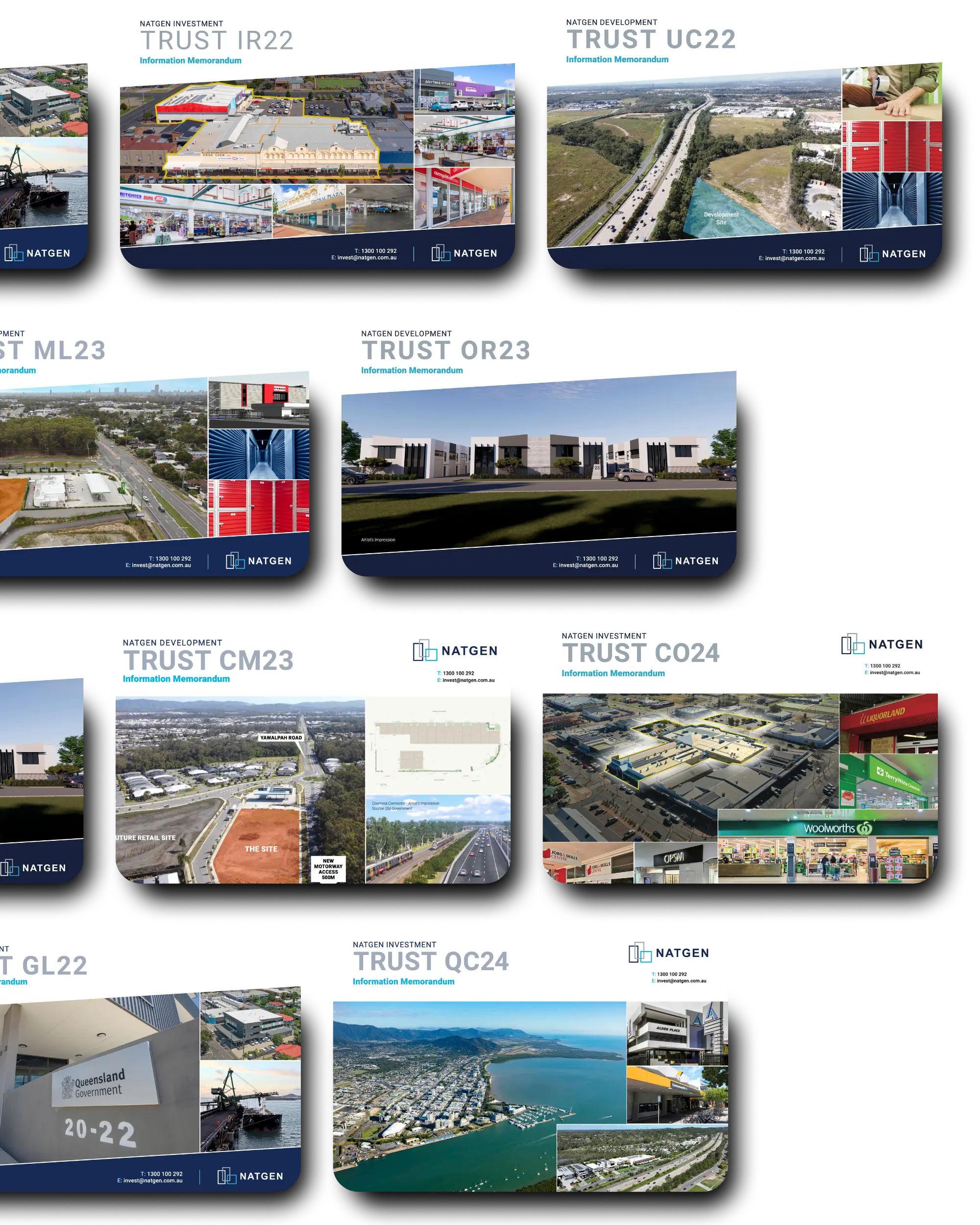

UNDER CONSTRUCTION

Natgen Development

Trust OR23

| $12.5 Million | |

| Tax Deferred Income | |

| Development Profit | |

| Industrial Warehouse Facilty | |

| Established in 2023 | |

| 18 - 24 Months |

UNDER CONSTRUCTION

Natgen Development

Trust CM23

| $16 Million | |

| Tax Deferred Income | |

| Development Profit | |

| Industrial Warehouse Facility | |

| Established in 2023 | |

| 18 - 24 Months |

UNDER CONSTRUCTION

Natgen Development

Trust ML23

| $28.2 Million | |

| Tax Deferred Income | |

| Development Profit | |

| Self Storage Facilty | |

| Established in 2023 | |

| 8 Year Term |

UNDER CONSTRUCTION

Natgen Development

Trust UC22

| $32.8 Million | |

| Tax Deferred Income | |

| Development Profit | |

| Self Storage Facilty | |

| Established in 2022 | |

| 8 Year Term |

COMPLETED

Natgen Development

Trust UC19

| $5.25 Million | |

| Tax Deferred Income | |

| Development Profit | |

| Industrial Warehouse Facility | |

| Completed in 2020 | |

| 1 Year Term |

We invite you to view our latest development site video updates that monitor site activity in June 2024 across our development portfolio.

- Access to development opportunities – We are constantly undertaking surveillance of the market to identify gaps and to match these gaps with qualified development sites.

- Development Expertise – The Natgen development team consists of industry professionals with decades of high-level property development experience.

- Australian Financial Services License – Ensuring full compliance with managed investments and investor protection laws. Not all development investment opportunities in the market meet these standards!

- Development Profits – The returns from Natgen Development Trusts aim to be higher than returns from more passive property investments. At the close of a trust term, any capital/development profits that have been achieved over the life of the fund will be distributed to unitholders.

- Non-recourse borrowing – Due to our size and structure we can borrow on advantageous terms. The Financier will have no recourse to any Investor personally or to the other assets of any Investor.

- Taxation Benefits – The Natgen trust structure allows investors to take advantage of the depreciation benefits available for commercial property. Income distributions will usually be fully or partially tax sheltered.

Natgen Development Trust UC19

Location: 18 Northward St, Upper Coomera QLD

Investment Status: COMPLETED

Purchase Date: April 2019

Completed Value: 5.25M

Return: 13.1% Targeted Investment Return

Fund Term: 1 Year

Tenants: Industral warehouse facility

Natgen Development Trust OR23

The Natgen organisation has the skills, expertise, process and governance to provide a high quality investment and property management service to investors within its investment and development trusts.

Our trusts display the combination of the following attributes:

Super Changes: What does the proposed ...

1,200+ followers