ALDER HQ’S $9M DEAL

Gold Coast-born construction and development company Alder has sold its Helensvale headquarters to a fund’s manager in a $9m million deal.

The 116 Siganto Drive property, built nine years ago, was bought by the Natgen group and is being put into a property trust.

The buy has been funded by an offer to investors of returns of 9.02 per cent, paid monthly, an offer that closed oversubscribed.

The fully let property is netting $668,165 a year, putting the buy on a 7.4 per cent yield.

The three-storey office building named Alder Place, which fronts the M1 motorway, will remain the Alder headquarters for at least 13 years.

The private group in 2015 won Master Builders’ regional, state and national awards for the design and construction of the building.

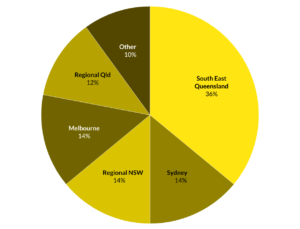

Alder, set up more than 20 years ago, has in excess of 100 staff and has delivered more than300 projects spanning the health, education, commercial and community sectors in Queensland and NSW.

The group has land holdings of 170ha throughout Queensland.

Alder managing director Greg Alder said Alder Place was the company’s flagship corporate HQand its sale allowed the company to satisfy its future growth plans.

“Alder created this award-winning building to ensure maximum connectivity to the M1 in both directions and to expose our brand and craftsmanship to a high number of daily commuters,” he said.

“We have chosen to sell the asset as it is one we no longer want to retain within our investment portfolio – it locks up capital for growth.”

The building is one of two being put into a Natgen trust – the other is a two-level office and retail property in Cairns.

Natgen managing-director Mr Goakes said the ability to acquire the Alder building below new replacement value underpinned the long-term value and growth potential.

“Building costs have risen precipitously in the last couple of years, which means we are able to buy good quality office buildings for significantly less than they would cost to replace,” he said.

“When we are looking for new assets for our investment trusts we seek unique opportunities in areas where we see long-term value.

“Vacancy rates are historically low on the Gold Coast, which is pushing rents up over time, and in today’s environment, where it’s not easy or cost effective to build any new spaces, we are looking down the barrel of tight vacancy levels for some time.”

QUENTIN TOD, Journalist