You’re listening to Mornings on ABC Radio Brisbane with Steve Austin.

The Reserve Bank of Australia made its cash rate decision yesterday.

It didn’t budge.

It’s clear.

It’s not straightforward as to whether inflation is actually beaten or not, although it does

look like it’s moderated according to the Reserve Bank, but they’re not confident of

the direction it’s yet to go.

So what does this reveal about the federal government’s policy settings?

Well, let’s go to Peta Tilse.

Peta Tilse is head of funds management at NatGen.

I spoke to her earlier this morning.

Steve, they didn’t even discuss any sort of cuts or anything like that this time round.

They still noted the tight labor market.

They noted that activity is picking up.

They also noted that productivity is flat.

So none of those things would ever suggest a further rate gap, to be honest.

So it kind of brings back into question what happened back in February, I would suggest.

What happened back in February?

Where they dropped it?

Where they dropped it, yeah, which really felt like Michelle Bullock was pressured into

it, because that was kind of the feeling from most in the market.

In the statement I read from Michelle Bullock, it’s quite clear to them that the RBA, it’s

not clear to the RBA which way inflation is going to go.

What does that say about the current Albertese government’s policy settings?

Anything?

Well, just remember there’s two sort of, I mean, it’s not all about the RBA show for

Australia.

I mean, we have monetary policy, which is what they control, which is the supply of money,

which is interest rates.

And then on the flip side, we’ve got fiscal policy, which is what the government controls,

and that’s to do with spending.

And as we saw at the budget with Jim Chalmers, et cetera, they’re continuing to spend and

we’re going to have more debt, and that’s actually very stimulatory to an economy, which

is kind of putting the foot on the accelerator, so to speak.

Then this counterproductive problem, we’ve got one foot on the brake and one foot on

the accelerator.

Correct.

And we’re not really winging about interest rates being too high and trying to argue

for us, but you can’t have it both ways, I guess.

My guess is Peta Tilse, head of funds management at NatGen.

This is 612 ABC Brisbane.

What about then what we’ve heard from the opposition leader, Peter Dutton, he’s announced

that they’ll halve the federal fuel rebate for 12 months if elected.

Would that make any genuine dent in cost of living for people?

I actually think it will.

So if we look at the Albanese policy of cutting the tax ever so slightly to the point where

you get what is it, $5 a week or something like that, that doesn’t kick in until next

year.

So we’ve got 12 months to wait for that one, whereas this one will be instantaneous.

And what I like about it is that it’s not just for taxpayers, it’s for every person

in the economy.

And even if you don’t drive a car, even if you’re the pensioner that hops on the bus

and pays you 50 cent fare and off you go, you’re still going to benefit because when

you think about supply chains, when you think about going to the shops and buying your milk

bread, etc., that all has to get delivered or A produced and then B delivered to a shop.

So that will actually reduce the cost in that sort of part of the import.

And that will happen for everyone within Australia.

Well, that’s federal politics.

Let me ask you about something else that’s in my list’s minds and that’s housing.

So the RBA cash rate is of interest to people because what does it mean if you’re getting

a mortgage or you’re paying a mortgage?

How much is the value of a house risen in Brisbane over the last five years, Prita Tills?

It is insane, Steve.

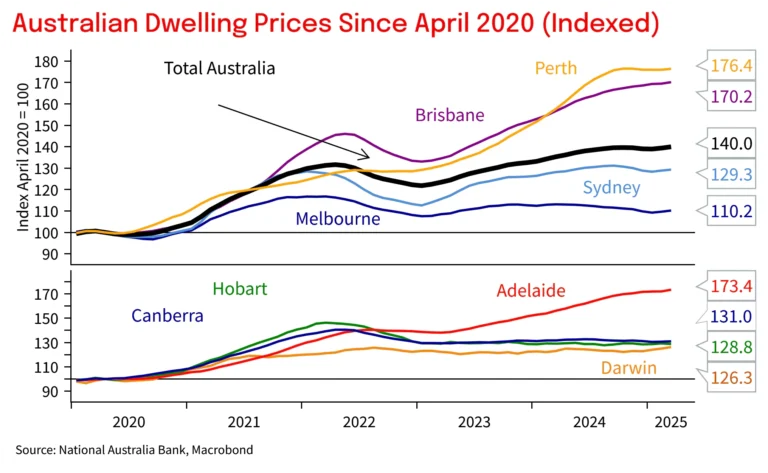

We had some data out yesterday and I was actually doing a pop quiz around the office to see

who thought which capital city had the highest sort of price rises over the last five years.

So this data is from April 2020 to now, so five years.

And if you think back to April 2020, it was sort of the middle of all the start of the

pandemic.

Okay.

So in terms of Brisbane, house prices have actually risen 70 per cent, seven zero.

So over five the last five years.

Yes, from then to now, that’s the measurement.

And in terms of which has gone up the most, it’s actually Perth, so they’re 76 per cent.

And who did the worst was actually Melbourne, unsurprisingly, 10 per cent.

If you own a house in Melbourne, it’s 10 per cent different from five years ago.

That’s how you interpret that data.

So if it was a million dollars, then it’s a 1,100,000 now sort of thing.

What world am I living in, Peta Tilse, if a cost of a house in Brisbane is greater than

the cost of a house in Melbourne?

What’s happened in the last five years?

Well, and it comes down to how an economy’s run.

This is literally it, right?

This is the crunch point.

And they had Dan Andrews lock everybody up.

They’ve got all sorts of problems, which they’ve just palmed off to Dysentralen.

And here we are with the amount and the debt in Victoria that the federal government or

whoever it is will probably have to help them along the way with some projects.

And so flip over to Queensland where we’ve got a mining sector that’s sort of kept everything

going for us, same with Perth.

And so they’re two of the strongest economies within Australia.

My guest is Peta Tilse.

She’s at NatGen.

She’s head of funds management.

We’re talking about the RBA decision and the cost of housing now.

Is are we in the housing bubble?

If the cost of a house in Brisbane or the value, sorry, of a house in Brisbane has increased

70% over the last five years, how is this not a bubble?

In my mind, bubbles pop.

How is this not a bubble?

Well, if we come back to economics, I’ll be boring.

And we look at supply and we look at demand.

Supply has not kept up with demand.

It’s quite simple.

And then therefore that impacts price.

Demand, don’t forget we, and some of the other data too that was released yesterday

shows the net interstate migration.

So remember, we had all those, as we call them, Mexicans, so to speak, coming over the

border to live in Queensland because it is quite cheap comparatively to other states

to live here.

And so Queensland still is leading the charge with net interstate migration.

So we’ve got, I think the number is, I don’t know, I think it’s like 28,000 people coming

in.

And conversely, we’re not building enough.

And what period of time is that 28,000 figure, Peta, tools?

I think that was the rolling quarter average.

Thank you.

So, yep.

And to be specific, anyway, so these people all need homes.

Then we’ve got also the fact that we’ve got net overseas migration.

Then we’ve also got the fact that people are still having babies and whatnot.

So population growth in Australia is about 115,000 people per quarter.

So if we’ve got that number of people coming into our country, they need to live somewhere.

And if we’re not building 115,000 houses per quarter, we’re just not kind of keeping

up with things.

That’s the supply, but also, sorry, that’s the demand, I apologize.

And conversely, the supply needs to sort of keep up with that.

So until that happens, we’re still in this kind of weird predicament.

Even in the commercial property world, so when we’re talking about shopping centers,

offices, et cetera, and this is sort of the world of nature and what we do, we just literally

settled on a shopping center for our investors on Monday.

And we’ve bought that 40% below the replacement cost.

So there’s a value in incumbent assets, like our assets that are already pre-built and whatnot.

And it means that for someone else to come in and build something that’s going to compete

with it, rents would have to be far higher.

So do rents go up?

Because it’s too expensive to build something here in Brisbane.

And so I had a quick look from a housing perspective.

So to build a house is anywhere from $3,000 to $5,500 a square meter.

And if the average size of a house is 226 square meters, we’re talking $633,000 as a

starting price to build a house.

Good grief.

So, yeah.

And then, like I don’t know about you, but I just got my rates, not my rates, my land

valuation notice.

Yes, I did as well.

Yep.

It’s up 20%.

Mine’s up 20%.

So, you know, it’s just incredible.

It hits you from every which direction, Steve.

Peta Tilse is an economist.

She’s head of funds management at NatGen.

Peta, I said on radio yesterday that in Brisbane you need to be a millionaire to own

an average home.

And a couple of listeners objected saying, well, you don’t need to because the bank will lend you money.

So I did a little exercise.

I went on artificial intelligence.

So I did what everyone else says you should do.

You’d have a mortgage of about $100,000 below the average mortgage, by the way, $510,000

at 4% interest, which is once again below the market rate over 25 years.

And you end up paying over $2,600,000 for an average house.

And I’m just thinking…

Incredible.

How is this not madness?

How is this not madness?

I mean, at some point something’s going to break.

Yeah.

And I think, you know, maybe it’s, maybe it’s a, we’re at a juncture where we give away

that sort of Australian dream of owning your own home.

And maybe it’s your renting your own home, which is the sort of more European model.

So, you know, maybe that’s where we’re getting to.

Peta Tilse, thank you very much for your time.

Cheers, Steve.

Peta Tilse, Head of Funds Management at NatGen.

1,600+ followers