Since Natgen last wrote on the future of interest rate policy and market movements (approximately 6 months ago), the economic landscape is hardly recognisable.The world of November 2021 has now endured:

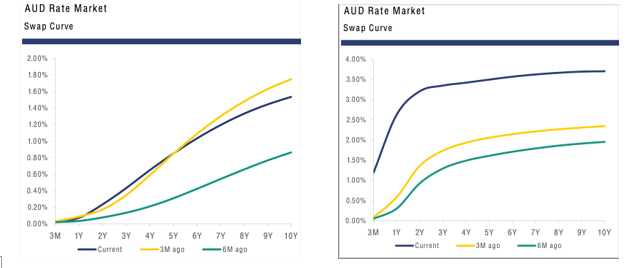

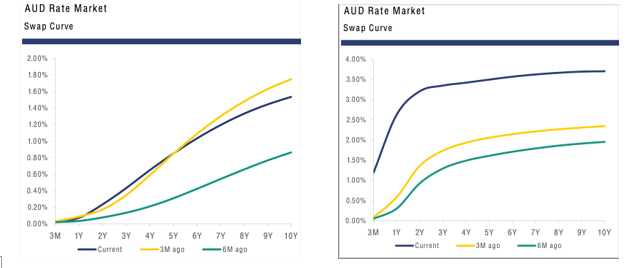

Market priced forward fixed rates as at 24 June 2021 and 2 June 2022: (please note the difference in the Y-axis scale on these graphs)So, we are now aware that short-term significantly higher interest rates are now a reality. Thus, we must ask the inevitable questions:

(please note the difference in the Y-axis scale on these graphs)So, we are now aware that short-term significantly higher interest rates are now a reality. Thus, we must ask the inevitable questions:

- the rampant spread of the Omicron strain of Covid-19 which, whilst generally less severe, is the most virulent strain. This has resulted in mass infections (thankfully following mass vaccinations) and the resultant labour shortages globally;

- the lock-down of China (and thus its productive capacity) seeking to eliminate Omicron;

- the Russian invasion of Ukraine, disrupting exports from this important European supplier and massively changing the trading relationship of Europe (and beyond) with Russia, at least in the near term; and

- devastating floods in South East Queensland and Northern New South Wales, disrupting important fresh food supplies to much of the eastern seaboard of Australia.

| The assumption is that the next interest rate movements will be upwards. | Yes – this has come to pass, but at a pace and extent that was broadly unexpected in November. |

| Governments and the banking/finance communities worldwide have a vested interest in keeping interest rate movements within a tolerable band for mortgage holders in particular. | Whilst the general proposition remains true, other influences (inflationary pressures) are greatly impacting the ability of central banks to maintain this goal in the short term. |

| Our base case assumes a doubling of effective interest rates within the next interest rate cycle, meaning in increase over the coming years of approximately 2% per annum. | The market is now pricing in a possible tripling of interest rates, however Reserve Bank indications are not going this far – more on this later. |

| The speed of interest rate increases is unable to be accurately determined, so we use the market rates for BBSY between 90 days and 10 years as an indication of the market view of the expected rate of rise in interest rates. | The precipitous rate on interest rate rise bears no resemblance to the indicators as late as October / November 2021. |

| Our financial models for Natgen investment trusts assume a commencing interest rate above the current short term BBSY (bank bill swap rate) and provide an increase in this rate during the latter years of Natgen investment trusts based on advice from financiers, other market participants and Reserve Bank guidance. | As part of our ongoing analysis of trust performance, we have remodelled each of the Natgen trusts in the light of recent interest rate data. The interest rate ‘headroom’ which we allow in all Natgen trust cashflow is certainly now fully employed in the current environment.Even within the last 3 months, Reserve Bank guidance has effectively done a 180 degree backflip, with ‘front loading’ of interest rate increases being dramatically opposed to previous guidance. |

| The response to this interest rate information may vary. | This remains true. With the benefit of hindsight and better guidance from the Reserve Bank, the response may vary over time. |

(please note the difference in the Y-axis scale on these graphs)So, we are now aware that short-term significantly higher interest rates are now a reality. Thus, we must ask the inevitable questions:

(please note the difference in the Y-axis scale on these graphs)So, we are now aware that short-term significantly higher interest rates are now a reality. Thus, we must ask the inevitable questions:- How high and for how long?

- Was this foreseeable?

- What do we do about it? How high and how long?The answer to this question depends largely on two further questions:Is the inflation caused by supply-side disruption a spike or will it be more persistent? This largely depends when the supply constraints ease and the response of governments in the meantime.Australian inflation has been less than in other developed economies and high wages inflation at this stage has not been detected to any great degree, notwithstanding labour shortages and an unemployment rate in the high-3% range.Will the inflation spike be ‘baked in’ to the economy by some form of inflationary government policy response? Whilst Labor governments are reputed to be big spending in nature, the Treasurer has indicated that they have constraints on expenditure forced upon them by the current fiscal position of the federal government. This indicates some level of restraint may be displayed in this regard.On the basis of their interpretation of the answers to these questions (and other considerations), our latest advice from the Commonwealth Bank is that the currently aggressive interest rate increases being experienced in the market (and edicted by the Reserve Bank) are likely to lessen the duration of the interest rate peak, but inevitably increase its magnitude. The Commonwealth Bank is now factoring in a moderation of short term interest rates in late 2023. This depends on the higher interest rates impacting inflation quickly without overshooting the economy into serious recession.In terms of how high, it remains difficult to determine. Whilst global rates can be a guide, there are differences in the global interest rate markets which provide a cogent reason for variation. For example, the Australian market – both home mortgage market and commercially – is by and large a variable rate market. This means that interest rate variations have their economic impact more quickly than predominantly fixed rate markets. (In the US, it is possible to take a home mortgage with a 30 year fixed rate.)Was this foreseeable?There is little doubt that increases in interest rates in the future were foreseeable, given the economic shocks being felt through the world economy. Also, if for no other reason than an historically low emergency interest rate was unlikely to be maintained in the long term.What has surprised most – including us – is the timing and speed of the increases. Of course, with the benefit of the data now available, there will be many who proclaim that they were fully aware of what was going to happen and when. Unfortunately, none of these economics savants seem to have been employed by the Reserve Bank or other central banks.What do we do about it?Regardless on the circumstances, the remit of Natgen remains clear and unchanged. In the November article, I concluded by saying that Natgen will continue to take a risk-managed approach to interest rate decision making, with unitholder return and risk reduction as the central considerations. In fact, these considerations remain central to decision making in relation to all our management obligations.Whilst the unusual speed of change in the interest rate environment has rendered some interest rate risk measures less effective (and much more expensive), there are still many management actions which impact performance regardless of interest rates.For example, we maintain a close watch on tenant payments and ensure that we become aware of any payment delinquencies. Cashflow management is very important at all times. Of course, we are also ensuring that rental reviews are carried out promptly and fully when due. This provides regular and significant rental revenue increases, assisting to offset increased interest rate costs.As always, we continue to seek value-add opportunities within managed properties, specifically directed toward revenue increments.As this very dynamic interest rate environment continues to unfold, we will keep you informed about what the market is forecasting, what the Reserve Bank is planning and our responses to each.Please feel welcome to reach out to us if you would like to discuss these matters in more detail.

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au