The Office Market is Turning - Are You Positioned for the Recovery?

After several years in the shadows, Australia’s commercial office market is showing clear signs of life. While headlines over the past few years have focused on hybrid work, elevated vacancies and rising interest rates, the fundamentals are now shifting – and astute investors are beginning to act.

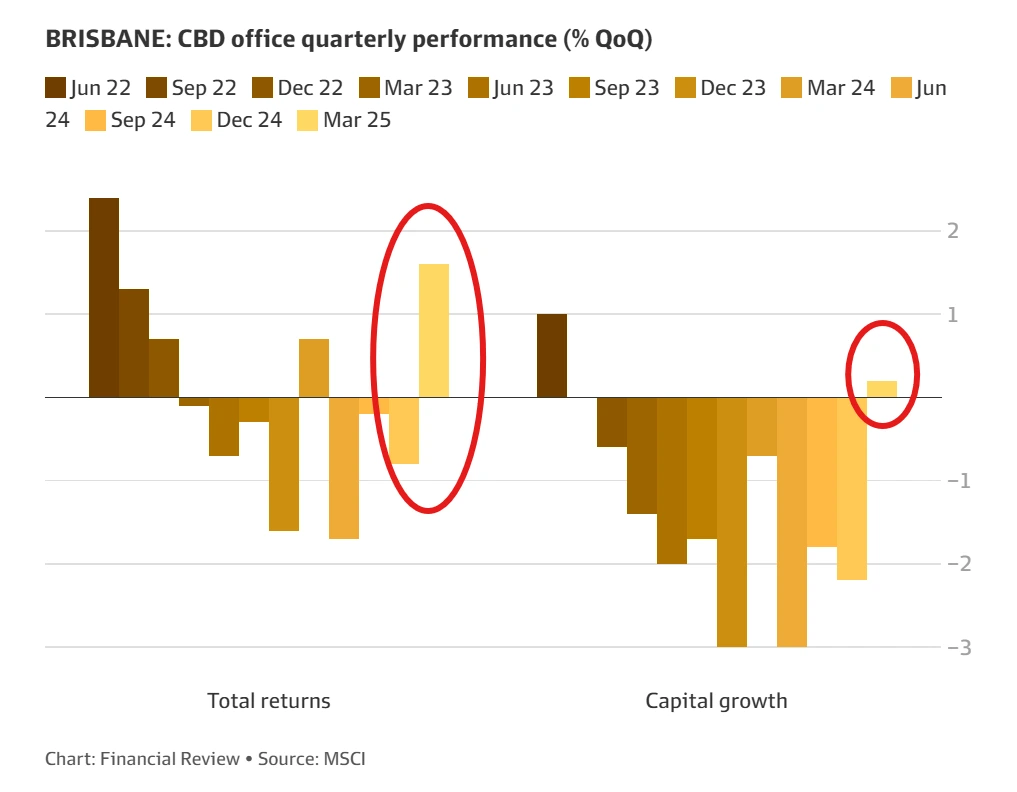

Recent reporting from The Australian Financial Review points to a noticeable change in sentiment, with large CBD office towers posting their first price gains in three years and institutional capital re-entering the market. The evidence is mounting: the cycle is quietly turning – but it still comes down to location.

Structural Constraints Are Driving Opportunity

What makes this turning point particularly compelling is the absence of speculative oversupply. Unlike previous commercial property cycles where demand lifted into a flood of new development, this recovery is being shaped by scarcity. High construction costs, labour shortages, and tightening lending conditions have made new office development financially unviable in most markets. That scarcity is already showing in stabilising incentives and rising face rents – particularly for well-located, energy-efficient assets with strong tenant appeal.

These conditions make countercyclical office investment in key markets particularly attractive – and central to Natgen’s investment philosophy, which prioritises income resilience and capital growth potential.

Location is always key – and Brisbane is a standout. With above-average net absorption, a robust small to medium enterprise (SME) rental base, and significant ongoing infrastructure investment, the city continues to attract and retain corporate occupiers. The upcoming decade of infrastructure spend – more than $107 billion – is supporting demand while also tying up labour and resources – further limiting new project feasibility. As a result, existing assets in strategic, inner-urban precincts are poised to benefit from improving leasing fundamentals and growing competition for space.

Natgen Investment Trust SG25: Exposure to the Upswing, at a Discount

Natgen’s latest opportunity, Natgen Investment Trust SG25, offers investors early-cycle exposure to this recovery. The asset is a fully leased, energy-efficient office building in Southgate Corporate Park – one of Brisbane’s most tightly held business precincts. With a 5.0-star NABERS Energy rating, strong blue-chip tenants, and excellent transport and amenity access, the asset is well positioned to benefit from both tenant retention and future rental reversion.

Importantly, the asset is being acquired below replacement cost, providing a built-in valuation advantage. In a market where new supply is constrained and sustainability aligned assets are commanding a rental premium, this creates meaningful upside potential – both in income and capital value over the medium term.

A Window of Opportunity

History shows that property markets don’t ring a bell at the bottom. By the time the momentum is obvious, much of the early value has already been captured. The re-rating of the office sector has begun – and opportunities like SG25 offer a rare combination of strong income, high-quality tenants, and real capital growth potential in the years ahead.

Now is the time to be selective and profit from Brisbane’s infrastructure decade.

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au