Six Tips For Commercial Property Success

For investors of all sizes and levels of sophistication, commercial property provides a very attractive investment option.

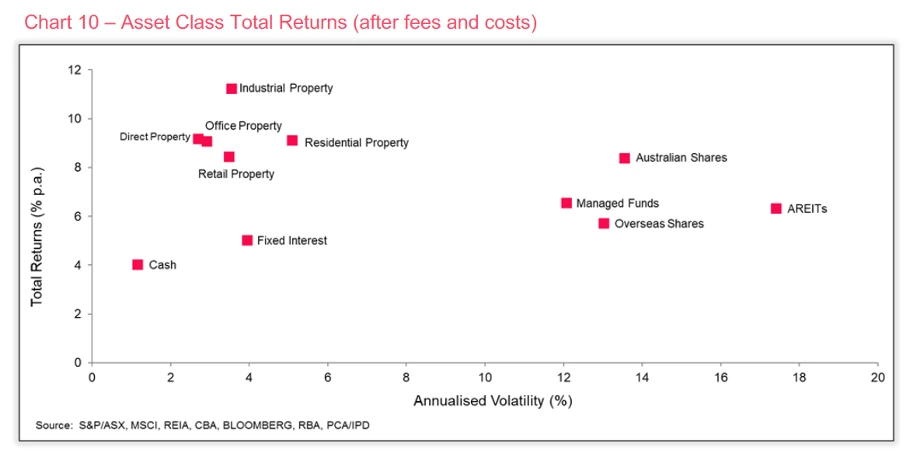

Negative correlation with returns in other asset classes and high levels of transparency are attributes which can hold investors’ long-term interest in commercial property. However, as with any investment asset class, there are pitfalls to be avoided.

The following six tips will assist in successfully navigating the pitfalls to leverage the best attributes of commercial property.

1. Think Long-Term

The benefits of commercial property investment typically manifest themselves over time. For example, income growth through annual review mechanisms in leases build over time, especially for long-term leases.

In addition, transaction costs associated with purchases (stamp duty, due diligence costs, etc.) are amortised over time, becoming less significant in a capital sense the longer the property is held. Whilst short-term gains are possible through opportunistic purchasing and good management, these gains can also be accretive over the long term.

2. Security Of Income Is Key

In commercial property, the value of the income stream is the most important aspect in determining investment value.

Thus, the quality and security of the income stream must be assessed, maintained, managed and grown over time. This is fundamental to achieving value growth.

3. Be Prepared To Actively Manage

Commercial property is an investment asset class where effective, active management of the asset can reap long-term rewards. Strategic management and capex plans ensure that reinvestment in the asset is rewarded with income consistency and growth.

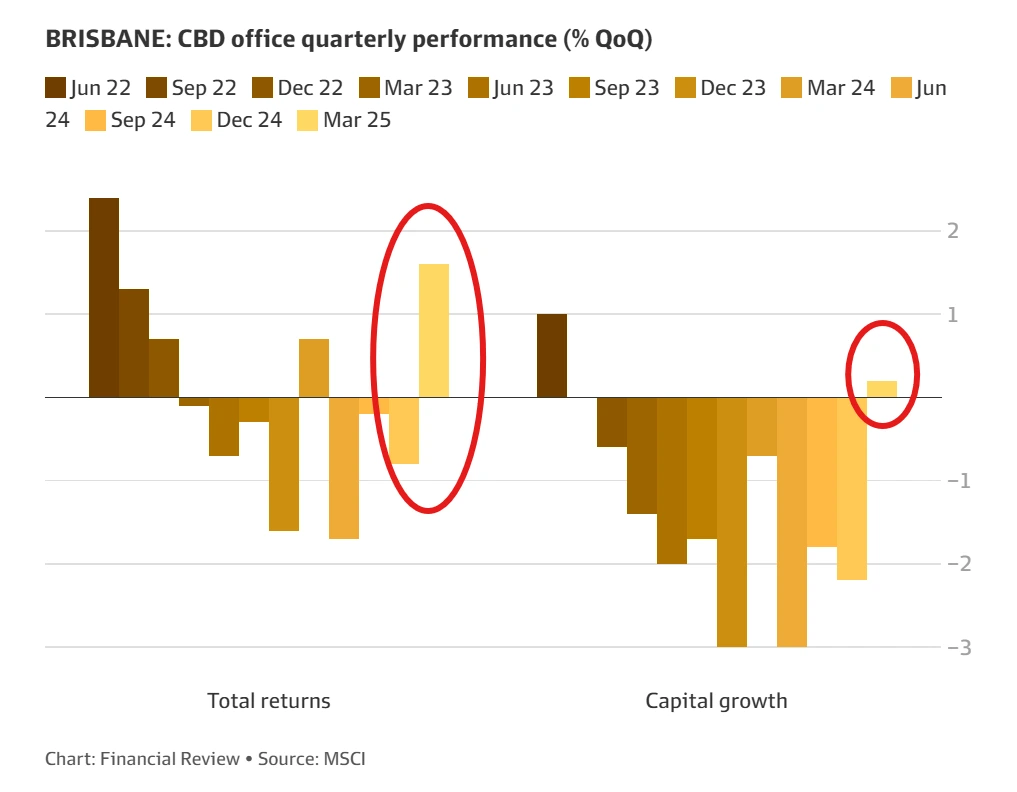

4. Be Cognisant of Property Cycles and the External Environment

Like most investments, commercial property returns can be impacted by general economic cycles and external economic factors.

Commercial property owners should be vigilant about cycles and external factors when making decisions about purchase, major capex, and property sales.

It is particularly important not to be in the position of having to sell an asset at the wrong time in the cycle, such circumstances can substantially impact overall returns.

5. Borrow, but don’t Over-Leverage

Well considered and well managed debt can substantially enhance returns from commercial property investment. The level of appropriate debt will depend on many factors relating to the consistency of property income (with which to pay interest and redeem the debt).

Whilst debt in excess of the assessed appropriate level may increase returns further, it comes with an increased level of risk that should be taken into account.

6. Invest with Others

Commercial property investment can require very substantial equity capital, typically extending to several million dollars.

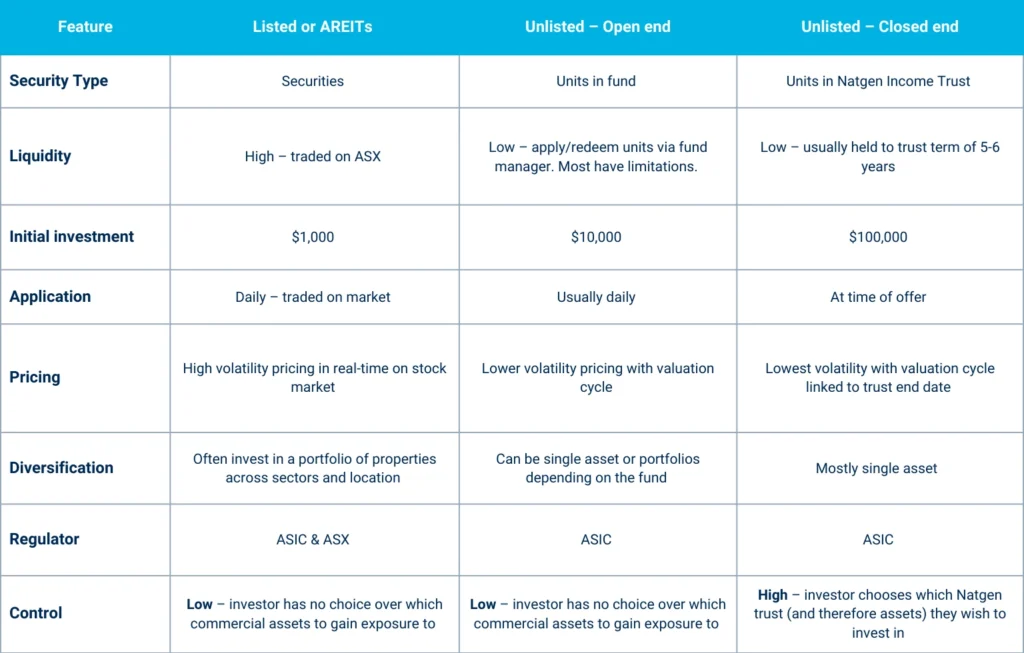

However, collective investment vehicles such as property syndicates, property investment funds and listed real estate investment trusts (REITs) make the commercial property investment market more accessible to those with less capital to invest.

“Commercial property investment can require very substantial equity capital, typically extending to several million dollars”

Conclusion

In order to assess and manage commercial property investment factors, a strategic approach to decision-making is vital.

Prior to acquisition, a defined acquisition process should be strictly observed. This will lead to better risk-managed purchase decisions.

Once acquired, commercial property assets should be the subject of a comprehensive business planning exercise, with strategic consideration of long-term capex requirements, lease reviews and expiries, and divestment options.

When diversity is considered, economic cycles and external factors must be considered to maximise the realised value of the property.

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au