Interest Rates and the Outlook for Commercial Property

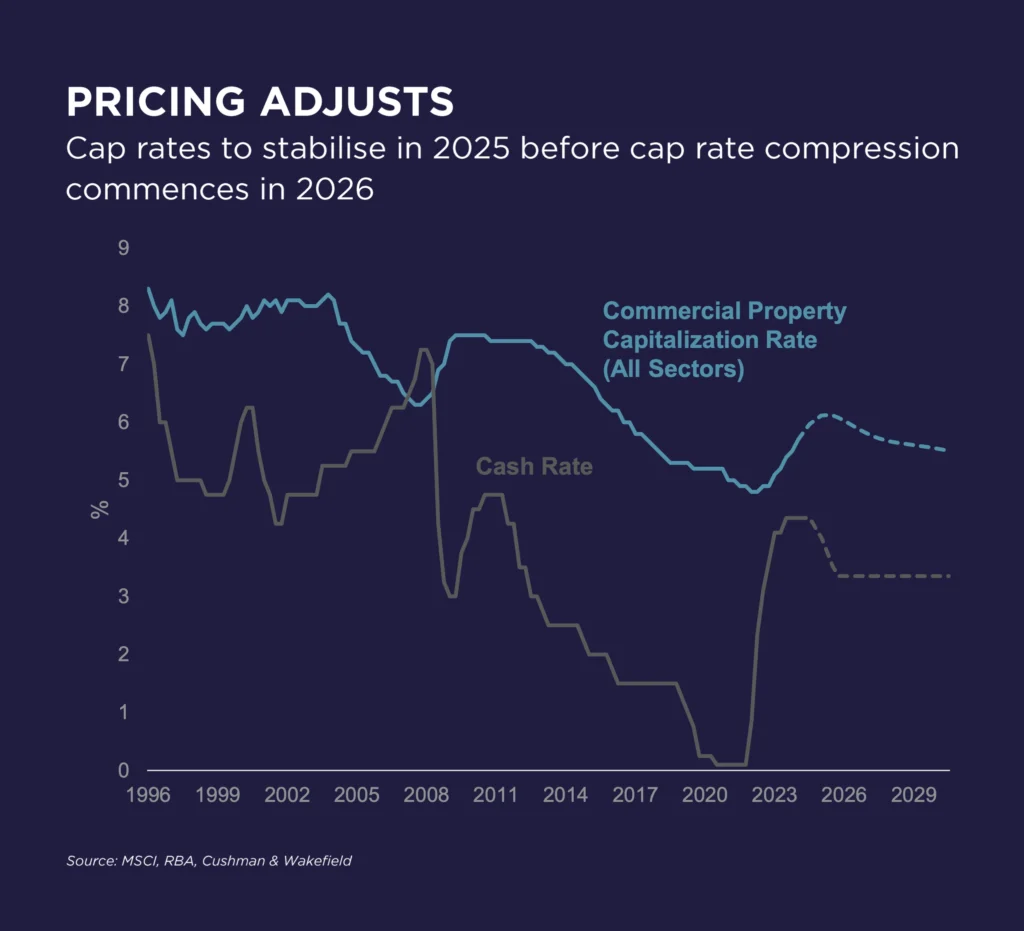

Typically, cap rates lag behind broader market yields by 6-12 months, providing a delayed but reliable indicator of market direction. Cushman & Wakefield’s analysis (see charts) suggests that market yields may have already peaked, signalling that the next phase of the cycle could be toward lower yields, and thus higher valuations.

For commercial real estate investors, certainty around interest rates is critical. As confidence in rate stability grows, this is likely to support greater certainty in the commercial real estate market, paving the way for future price recovery once rates begin to ease.

At Natgen, we carefully evaluate market dynamics to select assets and protect assumptions within our Investment Trusts. This ensures our investors benefit from market cycles while mitigating risk and optimising long-term returns.

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au