Why Commercial Property Brings Stability in Volatile Times

Equity and currency markets have had a brutal week. Major equity indices around the world plunged as trade tensions escalated sharply. The S&P 500 dropped 6%, the Euro Stoxx 50 fell 4.6%, and the FTSE 100 closed 5.0% lower for the week—wiping out billions in value as investors tried to digest the implications of sweeping new tariffs and the risk of a full-blown trade war.

At the centre of the storm is the United States Government’s latest policy announcement introducing a 10% tariff on all US imports, with reciprocal measures escalating as high as 54% in some cases. China’s swift response—a 34% tariff on US goods, effective 10 April—has only amplified the uncertainty.

With global trade flows under pressure and financial markets struggling to reprice risk, investors are again searching for certainty.

Direct property stands out as a stabilising force.

Unlike equities, direct property doesn’t trade daily on sentiment. It is grounded in real-world fundamentals—tenants, leases, and physical assets that serve essential demand. Crucially, many sectors within direct property have low exposure to global trade shocks. The returns from medical centres, local convenience retail, self-storage, and suburban business parks are more closely tied to domestic drivers like employment, population growth, health spending and household formation, than to geopolitical flashpoints.

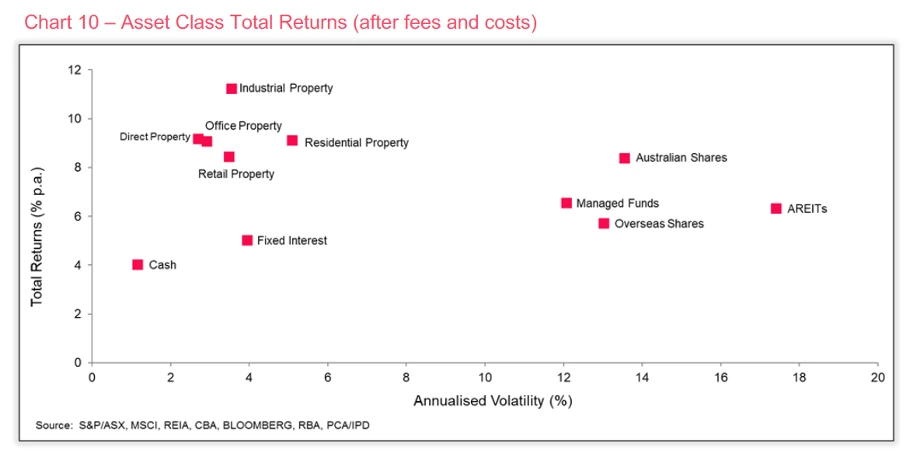

Historical data supports this. Research by Atchison and the Property Funds Association shows that over the long term, direct property delivers both solid returns and low volatility—an ideal mix when other assets are swinging wildly. Their analysis to 31 December 2022 shows Australian direct property produced average annual returns of 9.2% with volatility of just 2.7%. Compare that to Australian equities, which delivered a slightly lower 8.4% return but with five times the volatility (13.5%). A-REITs, despite being listed property, followed a similar path to equities with higher volatility.

Importantly, direct property is not just about income. For well-selected assets, capital growth plays a key role—particularly as cost-to-replace rises and rental demand strengthens. While REITs and listed markets feel the immediate impact of macro policy shifts like interest rate changes or trade moves, direct property values tend to move at a different pace, guided by supply, demand, and leasing fundamentals.

With equity markets now pricing in rising recession risk and investors facing a potential “deleveraging spiral,” as some analysts are calling it, capital preservation is back in fashion. Real assets—particularly direct commercial property—have long offered investors a steady, tangible anchor in their portfolio.

In uncertain times, where the outlook is as much about headlines as it is about fundamentals, it pays to hold assets that are decoupled from day-to-day sentiment. Direct property doesn’t just provide diversification—it provides refuge.

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au