Regional Shopping Centre Property Investment

8%* p.a.

Regional NSW location

- 100% freehold interest

- Anchored by Coles

- Buying below Replacement Cost

- Distributions paid monthly

- 5 - 6 year investment term

- $100,000 minimum investment

*Subject to confirmation in the Information Memorandum

FULLY SUBSCRIBED

Regional Shopping Centre Property Investment

8%* P.A.

Regional NSW location

*Subject to confirmation in the Information Memorandum

- 100% freehold interest

- Anchored by Coles

- Buying below Replacement Cost

- Distributions paid monthly

- 5 - 6 year investment term

- $100,000 minimum investment

Natgen Investment Trust CA25

Location:

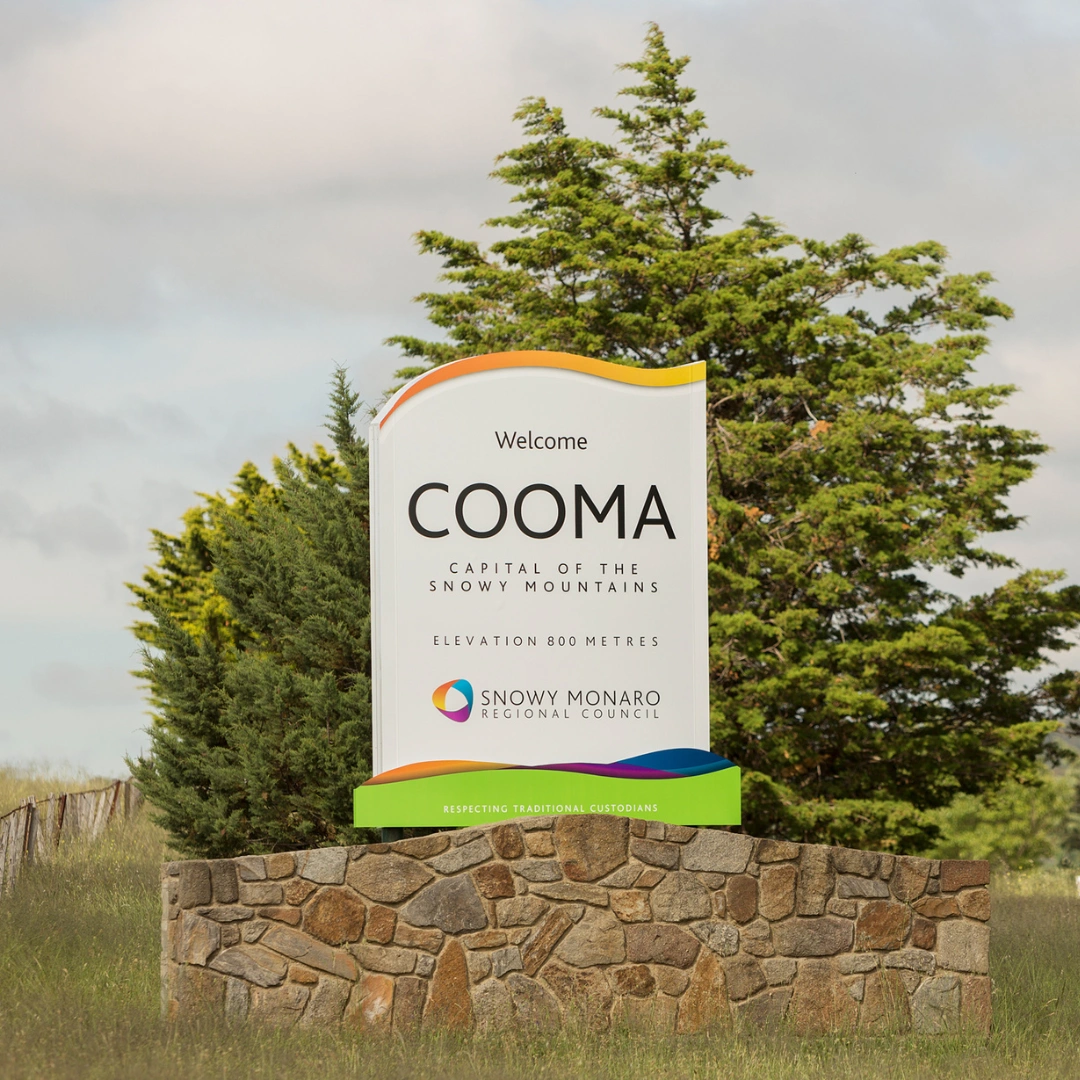

Cooma, NSW

Property Location

Cooma – known as the “Gateway to the Snowy Mountains” is a vibrant regional centre with a local authority population of over 22,000 (2023) and 2.7 million annual visitors. Located 115 km from Canberra and 390 km from Sydney, Cooma serves as the Snowy Mountains’ main commercial hub, servicing residents and attracting visitors year-round.

$15.85M

Trust Capital

Stability with Growth Potential

Regional NSW retail centres offer stable, high-occupancy investments that attract steady capital. Limited new developments in regional NSW (due to construction cost pressures) are driving rental growth and enhancing asset values, supporting sustained investor demand and liquidity.

8%* p.a. paid monthly

Targeted Distribution Rate

Capital Profit Opportunity

The centre is anchored by a high-performing Coles Supermarket on an initial 22-year lease to 2030, with 20 years of options. Supported by The Reject Shop, Commonwealth Bank, Bendigo Bank, 9 specialty stores, and three office tenancies.

The Centre is being acquired at approximately 40% below replacement costs.

Investors are invited to the opportunity to own part of a key regional convenience retail property (1 of only 3 in the 15,162 sq.km Snowy Monaro region) anchored by a lease to a full-line Coles, and being purchased approximately 40% below perceived replacement value. Located in Cooma; the gateway to the Snowy Mountains, Centennial Plaza represents a dominant neighbourhood convenience generating a resilient income stream mostly from national and chain retailers of over $1.29m p.a. The Snowy Monaro region is home to 22,000 residents, and attracts around 2.7m visitors annually.

Lease Profile

Centennial Plaza accommodates a full-line Coles supermarket on an initial 22-year lease to 2030, with 20 years of options.

80% of specialty income has fixed annual increases of 3% or more with 73% of income being generated via ASX-listed companies throughout the centre, supporting predictable rental growth.

Tenant Profile

Economy

The key pillars of the Snowy Monaro regional economy are tourism, electricity generation and supply, agriculture and forestry, and manufacturing. Tourism contributes 17.1% to the Snowy Mountains’ economy.

Cooma captures about 25% of the region’s 2.7 million annual visitors, boosting local business.

The Snowy Scheme

Described as one of the civil engineering wonders of the modern world, the Snowy Scheme consists of eight power stations, 16 major dams, 80 kilometres of aqueducts and 145 kilometres of interconnected tunnels. Cooma is the administrative epicentre of the Snowy Scheme.

Growth Potential

Regional NSW retail centres draw strong investor interest and drive market liquidity. Retail assets in Australia maintain a 98% occupancy rate, with regional NSW assets offering stable, high-occupancy investments attracting steady capital. Limited new developments in regional NSW are driving rental growth. High replacement costs are underpinning long-term asset values.

The Snowy Hydro 2.0 Project

The Snowy Hydro 2.0 project, a multi-billion-dollar Australian Government initiative, has spurred economic growth, generating over 4,000 jobs and driving demand for housing, social services, and local business.

In response, rental prices have risen by 25%, and the NSW Government plans to add over 200 new homes to meet rising housing needs.

Media

Investment Trust CA25 Highlight Reels

FAQs

The Property/s will be held for a period of 5 to 6 years (subject to market opportunities), after which time the Property/s will be sold and net proceeds distributed to Unitholders.

Unitholders will have direct ownership interest in the Property through the structure of a Trust.

Distributions to unitholders are paid on the same day of each month to your nominated bank account.

Yes – self-managed superannuation funds can invest in Natgen Investment Trusts.

There is no early withdrawal mechanism, however a Unitholder is free to sell their Units during this period. (Transaction costs my apply). You should expect to remain in the Trust for the full term under normal circumstances.

Every Natgen trust is an ASIC-regulated wholesale managed investment trust. Investors subscribe for Units in the Trust. Each Unit entitles the Unitholder to share in the income and capital of the Trust, derived directly from the assets of the Trust, so you have a direct ownership interest in the assets of the Trust.

The Trustee is National & General Administration Pty Ltd, which holds an Australian Financial Services License (No. 522 835) issued by ASIC to act in this capacity.

Unitholder in a Natgen Investment Trust will receive the following –

- Monthly Distribution Statement

- Quarterly Reports providing updates on the management of the assets.

- Annual Tax Statement and full Financials at the end of each audited financial year.

- Craig Brennan

I am extremely happy with the quality and transparency of the research into the investment opportunities put forward by the Natgen Group. This has enabled me to invest in commercial sites with peace of mind , and has given me tax effective , regular income at a very acceptable return.

Athol NNatgen provides me with a great monthly income stream through its commercial property assets. The team is very professional and they always keep me well informed about the assets I have invested in.

- William Matthews

I have been investing with Natgen since 2020. What I have invested in are Steven and Brett. They are experienced, thoughtful, and always professional. I have not been able to find other fund managers who take on my experience and find investment strategies that suit my needs so well. Steven and Brett are an open book and are always happy to speak on the nut and bolts of a project which is why I am always happy to refer friends and clients to Nagen projects.

Lesley woodford-carrI like to know what I am investing in. With all projects there are risks, Natgen always has a detailed plan to address risk in the project and the market. Natgen's projects have the flexability suit my structures and fit in with my tax planning. Most importantly, I appreciate Steven's respect for my capital and the immedate monthly return on my investment.

- Jamie Brennan

Excellent communication and a great and easy way to diversify your investment portfolio in commercial property. Professional and provides a stable and attractive monthly income.

Garry & Erris BVery good communication and happy with the tax effective monthly distrubtions.

your future now!