Listed vs Unlisted Real Estate Investments

When it comes to investing in commercial real estate in Australia, most people believe they have to have upward of $1 million before they can purchase a property. The sheer size of capital outlay can prove prohibitive, but even if an investor can afford the outlay – it might be too hard to manage or provide too much concentration risk in one investment. This is where listed and unlisted real estate investments can be simpler and easier than direct property investment.

Listed and unlisted real estate investment trusts are merely a mechanism to pool investors, so that they might have a beneficial interest in a portion of a commercial property. Investors get a proportionate return of income, potential capital gain, and tax effectiveness depending on their situation. They have a further advantage over direct investing, as all the property management, banking arrangements, and accounting are handled by professional fund managers, and usually on more favourable terms. Trusts also quarantine risk, meaning there is no recourse to investors if there was a default on debt arrangements.

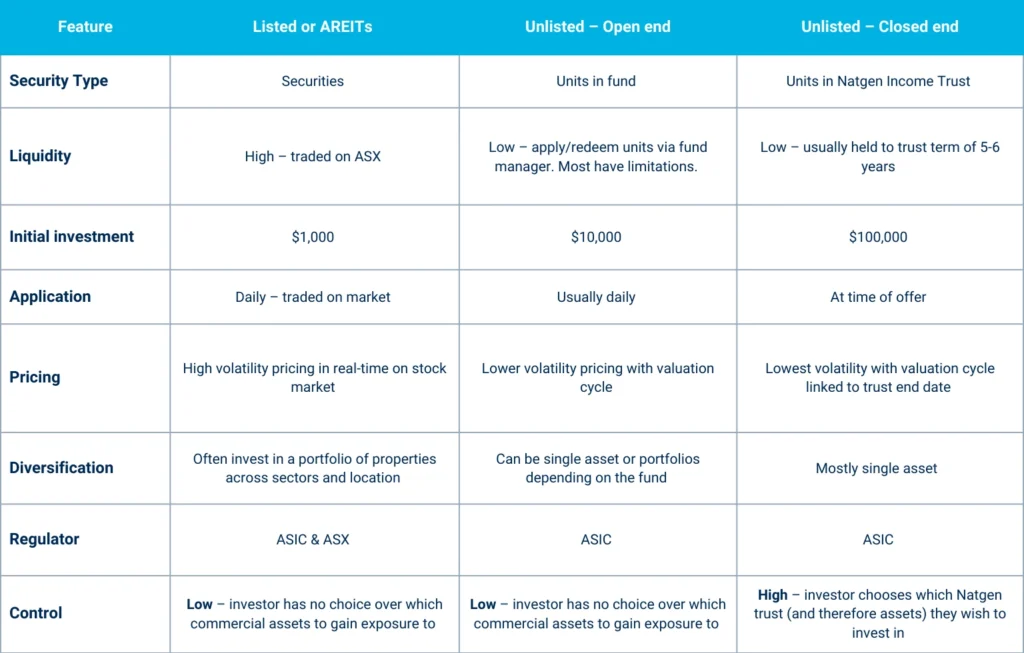

While both investment types offer opportunities to grow your wealth, they come with different features, benefits, and risks. Unlisted investments can be further divided into open end (taking investment daily) or closed end funds like the Natgen Investment Trusts. Features can be summarised as below;

This guide will break down these two investment types in simple terms, helping you understand which might be the best fit for your investment goals.

What Are Australian Real Estate Investment Trusts?

Listed Australian Real Estate Investment Trusts (A-REITs) are listed real estate investments which are traded on the Australian Securities Exchange (ASX). They usually own a portfolio of properties which are geared between 10-30%.

Typical benefits include:

- Ease of Access: You can start with a small investment amount via an online broker, making it easy for new investors to enter the market.

- Income and Growth: REITs typically pay regular dividends from rental income, alongside potential capital growth from property value increases.

What Are Unlisted Real Estate Investments?

Unlisted real estate investments involve investing directly in properties or in funds that own physical real estate, but these are not traded on the ASX. They can be;

- Open ended and accept applications for units daily but have limited liquidity, or

- Closed ended like Natgen Trusts – where investors have an agreed investment term for example of around 5-6 years.

Typical benefits include:

- Stable Income: Unlisted property trusts tend to provide consistent rental income, often at higher yields than listed REITs.

- Less Volatility: The value of unlisted properties isn’t affected by daily market fluctuations, leading to a more stable investment.

- Tailored Investments: Unlisted funds can be tailored to specific sectors (like medical or industrial) or locations, allowing for targeted investment strategies.

- Tax Benefits: Unlisted investments often come with tax advantages, like depreciation deductions and capital gains tax (CGT) discounts.

- Control: with closed end funds, you can choose if you want to invest in the trust and therefore a particular property.

Which Is Right for You?

Choosing between listed and unlisted real estate investments depends on your financial goals, risk tolerance, and investment horizon. The table above summarises features which some investors value over others. However, if you’re seeking stable income, tax benefits, and are willing to commit for the long term, unlisted investments like Natgen Investment Trusts could be more suitable – but as always you should seek advice as your personal situation may be different.

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au