Natgen in 2025 – busy times!

As we pass the quarter-post of 2025, the Natgen team is intensely focused and fully occupied.

It is now 5 years since the beginning of the COVID-19 pandemic, and it is fair to say that this one event has dominated the economic landscape ever since – perhaps at least until a certain inauguration ceremony in Washington DC is January this year.

In this 5-year period, we have become familiar with almost constant economic change. Quarter 1 of 2025 has been no exception. Whilst this can be challenging at times, the good news is that we at Natgen are accustomed to constant change within our markets and portfolio.

The outlook suddenly darkens

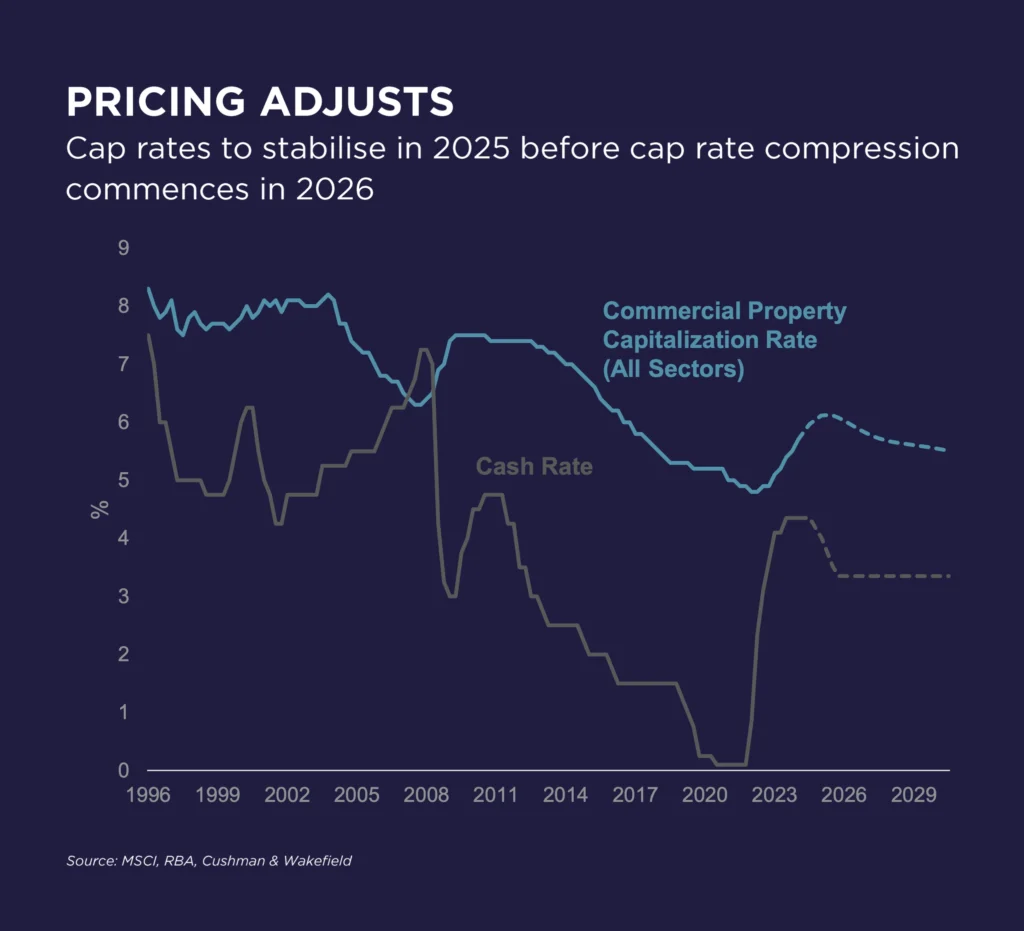

With the recent announcement of a broad tariffs regime being implemented by the United States, the general outlook for global economies has been dominated by gloomy commentary. Debt markets have responded to this by factoring in reduced interest rates in the medium term, consistent with the expectation of reduced global growth.

A comprehensive analysis of the impact of the US tariffs regime is well beyond the scope of this paper – we can all consume copious analyses over the days and weeks ahead from a broad range of analysts.

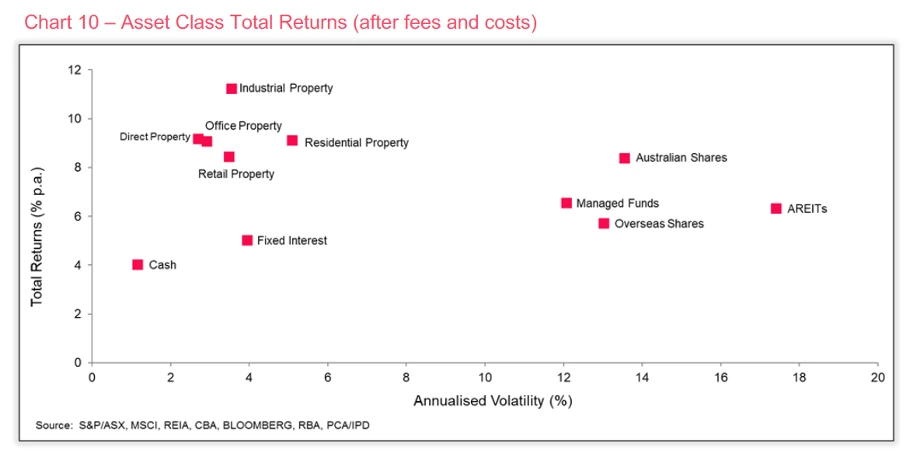

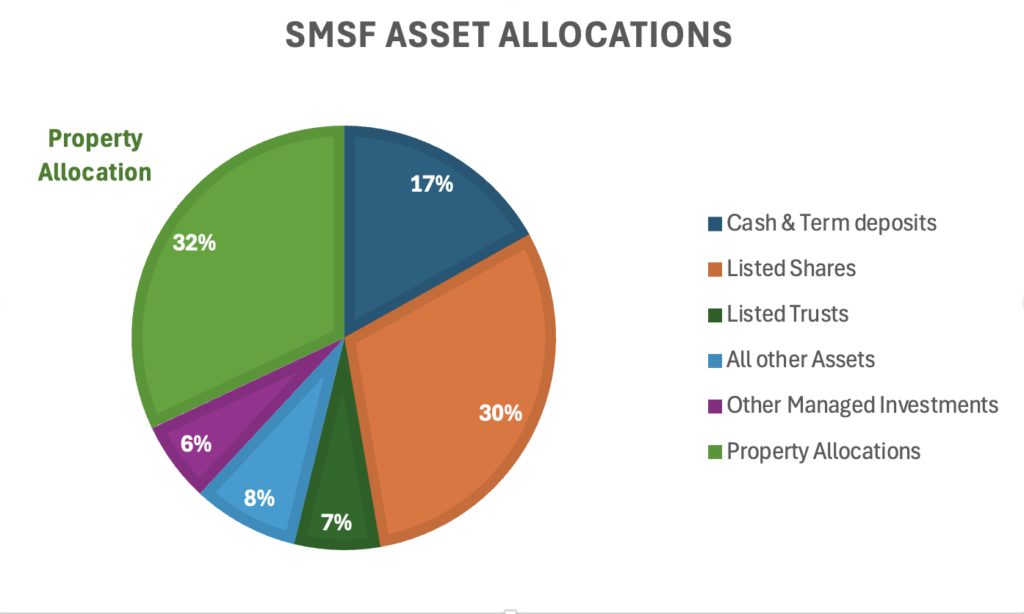

My initial reaction, however, is to feel affirmed that we have stuck to the basics when it comes to asset allocation and a concentration on defensive property assets where the provision of basic goods and services is the focus of our tenants. I believe that this has shielded us from some of the price variability in certain markets over the past 5 years and is likely to continue to do so into the future.

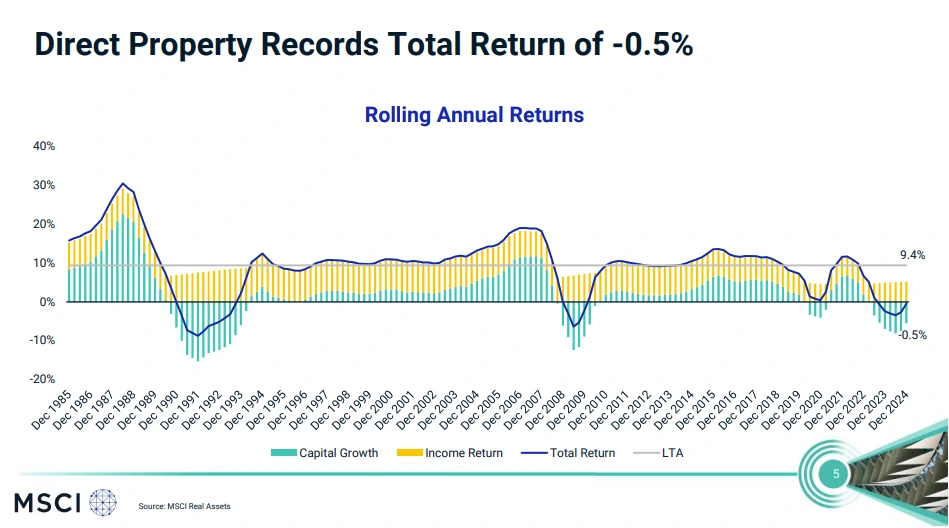

Of course, anyone invested in the share market currently is familiar with price variability. The current times provide a salutary contrast between share price variability and the relative stability of property assets and income production. We see this as a major benefit of commercial property investment.

Debt capital management and Interest rate management

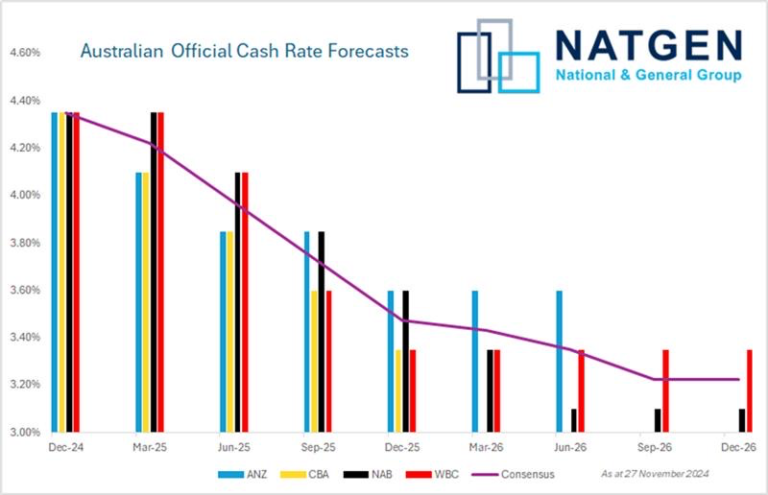

Even prior to the recent tariffs revelations, medium term market interest rates have been moderating. As I have mentioned previously to you, Natgen keeps a constant watch on interest rate projections and market pricing over the terms of our trusts. This is the basis upon which we formulate a view on the average 5 year interest rate over the term of Natgen Investment Trusts as stated in our information memoranda.

As the medium term rates have moderated, we have taken the opportunity to hedge our interest rate positions on a number of trusts including:

And also to seek reduced margin arrangements with banks on other trust debt including:

This activity has produced meaningful reductions in interest rate costs of virtually all of the trusts mentioned above.

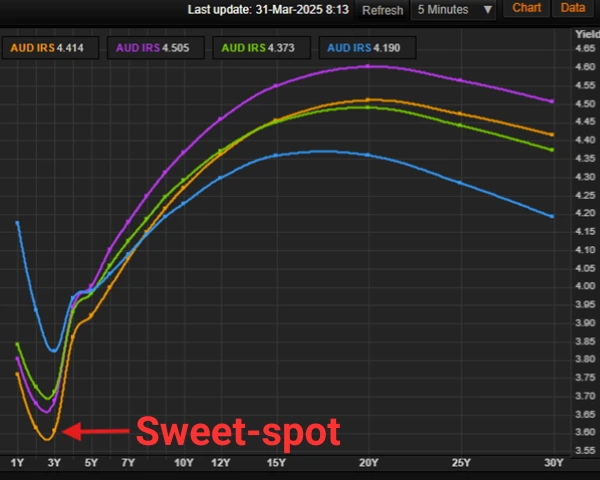

The aim of interest rate hedging is to limit the risk posed by interest rate variability on the performance of the trust by fixing the interest cost for a certain term. In the case of our recent hedging, we have been focussing on 3 year fixed terms, as this provides the best rates along the forward interest rates curve.

Graph source: Bloomberg, as at 31 March 2025

The Natgen Response

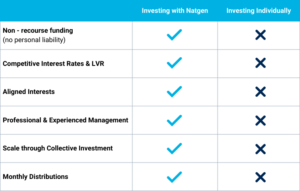

Consistent with the Natgen Investment Philosophy, we continue to seek assets which provide long-term defensive income and to acquire at prices which reflect solid value in the medium term. We seek to take advantage of the inefficiencies in the property market to target mis-priced assets.

Within this context, we continue to set target sectors based on our assessment of value. The following synopsis of our target areas outlines the value propositions we seek.

Regional Convenience Retailing

Well placed assets within solid regional locations provide steady income consistent with our aims, but generally at more favourable prices than metropolitan assets. Historical data indicates that approximately 30% of the nation’s GDP is derived in regional Australia. This figure underscores the significant economic role of regional Australia, whilst also producing the majority of the nation’s merchandise exports. Recently, the secret appears to be out and competition to acquire these assets is increasing.

Examples of Natgen trusts relying on regional convenience retail include:

Non-CBD Office

The CBD office sector was slammed during the pandemic due to stay at home mandates and the like. Work from home protocols emptied city office buildings. The whole sector has experienced downward value pressure, leading to value purchasing opportunities. Concurrently, steep rises in construction costs has made replacement of office stock unviable at current rental levels, providing existing buildings with a significant competitive rental advantage, especially in tightly-held precincts.

Natgen examples of non-CBD office assets include:

With another coming soon.

Value-add Industrial

Industrial property across the globe has benefited from the stampede to internet shopping during the pandemic and thereafter. This has focused principally on logistics and fulfilment, however, much of the traditional industrial stock is focused on manufacturing and its supply chain. This traditional industrial stock is transitioning to more modern industrial forms with the attendant uplift in values as the repositioning occurs. Natgen remains aware of this trend and vigilant for opportunities in this market. We hope to provide you with an example of this type of investment later in 2025.

Specialist Assets

Specialist assets are identified by there strong income generation attributes and sustainability of these income streams. Again, we look to certain sectors that offer certainty in times of volatility such as medical and logistic support. Tenants in these fields tend to have strong income generation linked to government spend, essential services or blue chip clientele. A Natgen example of this is Investment Trust SP24.

Natgen Developments in 2025

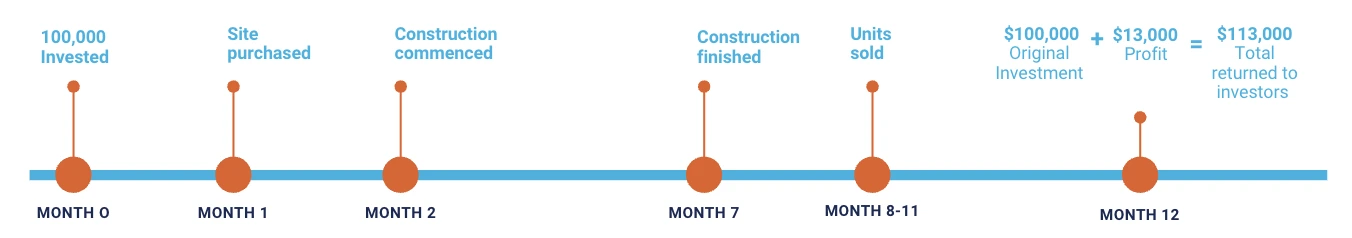

Natgen is set to deliver 5 development projects in 2025, with a total value in excess of $110 million. In all cases, the developments are being delivered within the initially-assess cost envelopes for each project. This has been an amazing effort by the Natgen development team.

The pipeline will continue to grow in 2025, with a Natgen Development Trust release imminent.

Whilst the sector focus of our development projects will broaden in 2025, the fundamentals which we seek will remain unchanged. These include a proven market, good-value sales expectations, and strong cost control.

Focusing on the basics

Beyond acquisitions strategy and development delivery, we at Natgen remain focused on delivery of the basic fund management and property management services upon which our Unitholders rely.

Words which we aspire to embrace are:

- Care

- Dependability

- Innovation

- Transparency

We look forward to providing you with new opportunities in both Natgen Development Trusts and Natgen Investment Trusts in the coming weeks.

Thank you for your time.

Steven Goakes

Managing Director

Natgen

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au