The dominant theme in the Australian economy in 2024 has been cost of living pressures catalysed by the precipitous interest rate increases during 2023.

Perhaps the other dominant theme has been the imminent expectation of interest rates reducing very soon after the top rate was reached. This expectation, perhaps based on early commentary of easing from foreign central banks, failed to take into account that foreign rates peaked substantially higher than Australian rates.

In any event, for much of the year it has been clear that interest rate relief would be slower and shallower than initially predicted. It is this eventuality that Natgen has been planning for in the operation of all Natgen Investment Trusts.

After not acquiring a single asset for a Natgen Investment Trust during 2023 (due to interest rate uncertainty), we finally found value returning to the market in 2024.

We commenced the year following our acquisitions theme of ‘Region Convenience Retailing’ with the purchase of a Woolworths – anchored shopping centre in Collie, WA.

Our second acquisition embodied our ‘non-CBD office’ theme, with a trust combining office assets in Cairns and the Gold Coast. These purchases were made at well below replacement value, given the precipitous rise in construction costs experienced in the post-Covid recovery period.

During a short hiatus in the middle of the year, we busied ourselves researching a new area of focus for us – specialist assets, including medical.

This research and understanding came to fruition with the purchase of the Icon Cancer Clinic for Natgen Investment Trust SP24. (We will continue to follow this theme into 2025 and beyond, where value can be isolated.)

Natgen Investment Trust SP24

Location: Southport, Gold Coast, QLD

Investment Status: FULLY SUBSCRIBED

Purchase Date: September 2024

Purchase Price: $9.65M

Return: 8% per annum (Paid Monthly)

Fund Term: 5-6 Years

Tenant: Specialty Medical

Location: 116 Siganto Drive Helensvale, QLD & 76 Lake Street, Cairns QLD

Investment Status: FULLY SUBSCRIBED

Purchase Date: May 2024

Purchase Price: $14.25M

Return: 9.02% per annum (Paid Monthly)

Fund Term: 5-6 Years

Tenants: Diverse tenancy profile of national and local tenants. Tenants include Commonwealth Bank of Australia and Alder Group.

Natgen Investment Trust CO24

Location: Johnstone Street, Collie, WA

Investment Status: FULLY SUBSCRIBED

Purchase Date: February 2024

Purchase Price: $10M

Return: 8.5% per annum (Paid Monthly)

Fund Term: 5-6 Years

Tenants: Woolworths supermarket and 8 specialty tenants

Natgen Investment Trust YB24

Location: Wongawallan Road, Yarrabilba, QLD

Investment Status: FULLY SUBSCRIBED

Purchase Date: August 2024

Completed Value: $10.137M

Return: 25.42% Targeted Development Return

Fund Term: 18 months

Tenants: Strata Titled

After making a number of very significant expert appointments this year, I am very much looking forward to 2025. The Natgen team is stronger than ever before and our strategic direction and mission is clear.

Our focus on serving the investment needs of ours unitholders is sharp and clear. In order to do this, we manage relationships with a number of important and often interconnected stakeholder groups, including the tenants in Natgen properties, financiers, local authorities, our builders and consultants and many others.

Care and consideration of the Natgen team is also vital in achieving our mission – a fact which is not lost on us.

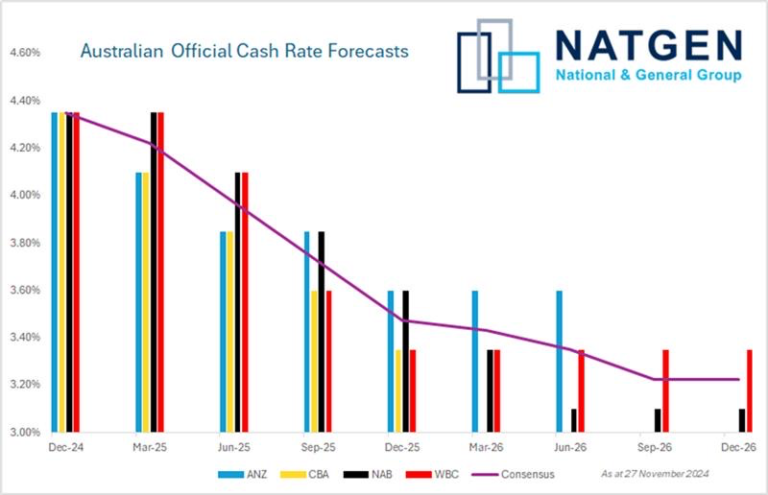

This graph plots the forecasts of the big four Australian banks for interest rate easing from the end of November 2024, through 2025 and 2026

Source: Natgen

With this as the background, we expect to continue to acquisitions activity along our established acquisitions themes, being:

- Regional convenience retailing;

- Non-CBD office;

- Value-add industrial; and

- Specialist assets, including medical.

We expect the first manifestation of our 2025 program to be released in January 2025.

If you have made it this far through this rather long and rambling treatise, I would like to take this opportunity to thank you for your interest and support for Natgen. As I mentioned at our recent Christmas function, the Natgen company is, in essence, a community. Each and every member of that community, be they at the centre or at the periphery, contributes to the whole.

I look forward to further communicating with you during 2025 to update you on our progress and future initiatives.

Merry Christmas and a Happy New Year to all.

Steven Goakes

Managing Director

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au