Click here for our Corporate Profile

As we proceed through 2023, and I look back at my last communication to you in January this year, it is clear that our expectations from the beginning of the year, are in general, coming to fruition.

At the beginning of 2023, I wrote to you about 2023 being a time to rethink our assumptions in changing times. I think most would agree this year has constituted changing times, and also a good time to rethink assumptions.

It is fair to say that from a domestic economic perspective, 2023 has largely been about higher interest rates designed for curb demand and thus inflation. Sitting here in December 2023, we are seeing some signs that perhaps the interest rate tightening cycle is achieving these aims, albeit with a reduced expectation of major interest rate drops in the coming 12 months.

Internationally, the turmoil of 2023 has been augmented by other conflicts further destabilising international markets. However, the major western economies appear to be gaining on the inflationary pressures they are battling and generally economic growth has not fallen off any cliffs.

The Natgen response to 2023 has been to indeed rethink assumptions and respond in real time to the challenges and opportunities presented.

In response to the realisation that higher rates will be more persistent than anticipated at the beginning of the year, we took the difficult decision to revise our return rates on two of our investment trusts to 7% per annum representing a reduction of 1.5% and 2% respectively. This was entirely due to interest rate impacts on sustainable return rates.

Also, as a response to a specific challenge, Natgen (in its personal capacity) bought the Kingsthorpe Medical Centre (a tenant in our Natgen Investment Trust KT21), specifically to maintain the tenancy mix at that property. We have significantly improved the services provided by the medical centre and, whilst the business is yet to be profitable, we expect to address this further during 2024.

Our assumptions about the impact of rising interest rates on the price of future acquisitions needed to be re-thought during the year. After withdrawing fromacquisitions activity early in the year, we found that prices remained at an unsustainable level, given market fundamentals, for much of the year. Whilst we found it difficult to find value in the standing assets market, we were able to demonstrate value in developments, with 3 new development trusts being presented for investment during the year. All of our four current development trusts address the demand for industrial space and storage in the high growth areas of the Gold Coast and the Brisbane / Gold Coast corridor.

Through Natgen Development Trusts, we have been able to provide our investors with a valuable alternative whilst we were struggling to ascertain value in the broader market. It is a matter of pride to us that we don’t offer investments when we cannot see value.

Another response to the circumstances of 2023 was to postpone the introduction of Natgen Liquidity Trust CF22 until the interest rate markets settle and we can be certain of our forecasting.

I hope that the theme that you ascertain for the above is caution. As I have said in the past, we take the stewardship of your investment funds very seriously and seek always to balance opportunity with caution.

2023 Investment Trusts Closed

The Opportunities of 2024

We foresee 2024 as providing greater opportunities than the year past. This optimism is based on current observations of some value re-entering the market. We thus expect to be able to bring you more consistent Natgen Investment Trust offers during 2024. As always, our offers will accord with our acquisition focus for the year and our general views relating to value – both short and long term.

As expectations of higher interest rates abate, we are now able to make more confident forecasts about future debt costs and thus returns from various asset types.

The broader economy continues to show signs of remarkable resilience, however we will continue to take a conservative approach given the complexity of the global political and economic situation.

New Head of Acquisitions - Jeff Gardner

In November this year, we welcomed Jeff Gardner to the Natgen team, fulfilling the role of Head of Acquisitions.

Jeff has been long known to me and we have worked together over a period approaching 20 years. Jeff’s long background in commercial property includes development management, property information systems and the full gamut of knowledge relating to markets and their dynamics.

With this valuable experience, Jeff adds a great deal of knowledge to our team. Jeff has already isolated a number of acquisitions targets based on the Natgen acquisitions focus areas.

Jeff will also be engaged in strategically reviewing and contributing to our future target areas.

Natgen - A helping hand in commercial property investment and development

Natgen has recently produced a document outlining some of the considerations to be taken into account when considering the inclusion of commercial real estate into a balanced investment portfolio.

I am pleased to provide you with a copy of this document at the link below.

Natgen Foundation - Supporting Legacy

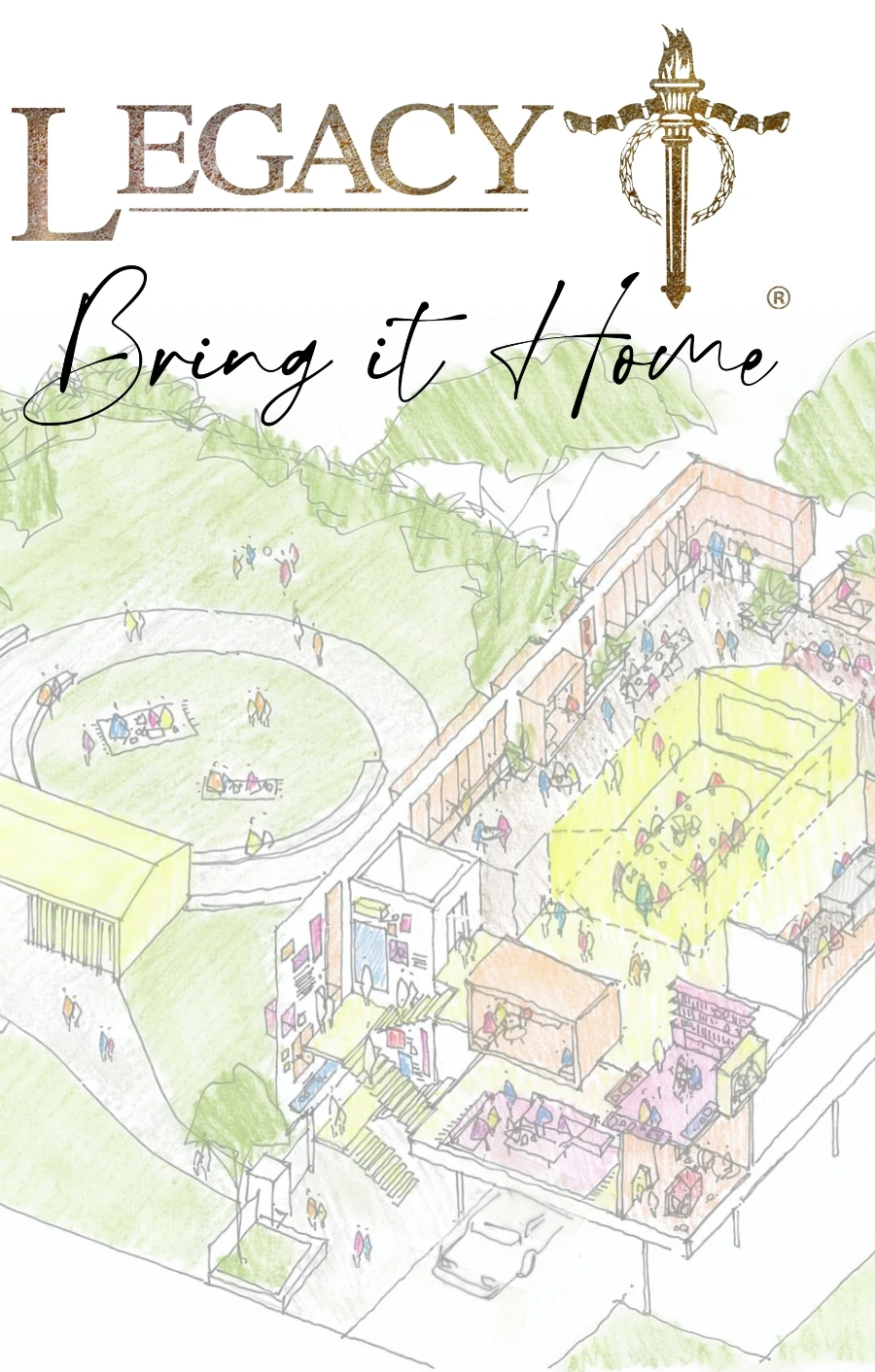

For 2023, Natgen Foundation has chosen the Legacy – Bring it Home Campaign as the major recipient of charitable contributions from the Foundation.

As Chair of the Campaign Cabinet, I am pleased to advise that the campaign is closing in on $8.5 million raised of the total target of $9.5 million.

This money is for the construction of a new Legacy House at Greenslopes Hospital in Brisbane.

The new Legacy House will be a focal point for the provision of Legacy Services in South East Queensland and beyond, responding to the changing needs of the families of our veterans returning from service to their country. It will be a model which we hope to roll out across the country in the coming years.

We plan to provide opportunities in 2024 for the Natgen community to help us with the last push toward achieving the total target. I thank you in advance for your interest and support in this endeavour.

Natgen Christmas Function

Thank you to all of our investors and consultants who were able to attend this year’s Christmas party held at the Southport Yacht Club.

Thank you for 2023

As we come to the end of another year, we want to take a moment to express our gratitude and well wishes to all our investors and partners. This year has been full of challenges and opportunities, but we are thankful for the trust and support you have given us. We hope that this holiday season brings you joy, peace, and rest.

Kind regards

Steven Goakes

Managing Director

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au