Investing in a Mortgage Trust vs a Property Trust - key things you should know

The example of a $500,000 asset financed by $200,000 of debt would have a loan to valuation ratio (LVR) of 40%.

Buying commercial property is not dissimilar to the concepts around buying a house (re debt and equity/deposit). The differences lie in

1. What asset is being purchased (eg):

- land to be developed,

- asset to be developed on land, or

- operating asset.

These each have their own inherent risks and may be subject to locational constraints, council approvals, development issues, or tenancy risk (to name a few).

2. How much is being loaned based on;

- Type and value of the asset (when was the last valuation and by whom?)

- the borrower’s deposit

- the borrower’s ability to repay

These factors all impact how much a lender may wish to loan the borrower (e.g. an LVR up to 50%). The borrower, in some instances, may have to take out several loans to achieve their purchase from different financiers, and some of these loans may be on riskier terms and rank behind other loans (e.g. LVR up to 80% based on old valuations).

Now that you have a handle on how assets are financed via a combination of debt (loans) and equity (deposits/investor capital), it is worth understanding how investors can make a return. The key to this is exploring the difference in risks and benefits of investing in a mortgage trust vs a commercial property trust;

Mortgage Trust and Unlisted Property Trust are both investment vehicles that can offer regular returns to investors. However, they operate quite differently and carry distinct risks and benefits.

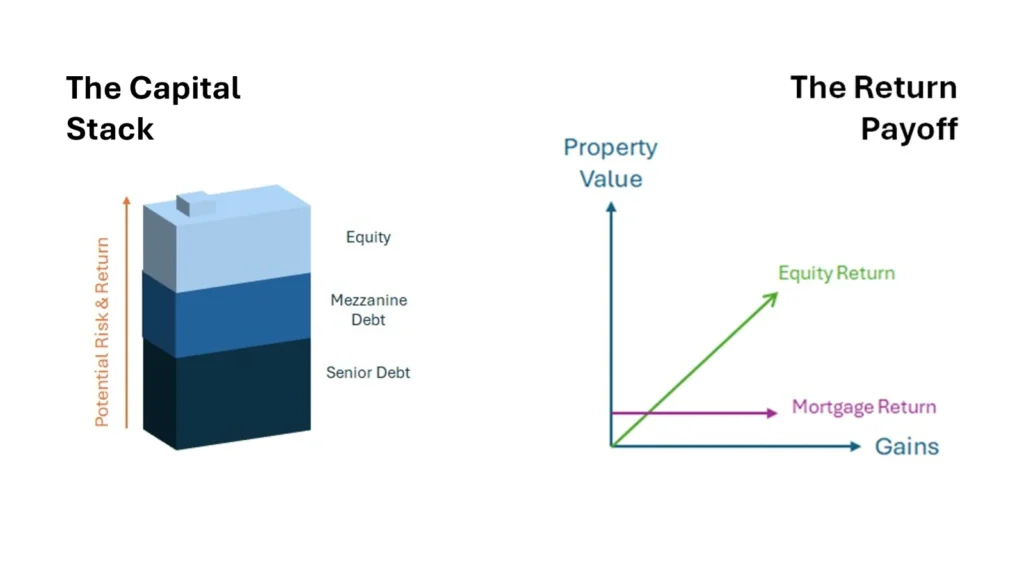

The concepts we have previously covered can be summarised in the following two diagrams. The Capital Stack shows how a property (asset) can be financed (debt & equity), and the risk of investing in that part of the structure. The Return Payoff illustrates that the best an investor in a mortgage or debt fund can expect is the interest payment, whereas an equity investor gets the benefit of any increase in the property’s value.

So, the question is…

Is 8% p.a income in a mortgage trust the same as 8% p.a from a property trust?

The short answer is No.

Assumptions:

- Investor is on the top tax bracket (excl. Medicare levy) 45% and can access the 50% CGT discount.

- Property appreciates 3% p.a. compounding annually, and asset is sold in the final year at this value.

- This scenario assumes inflation of 3% p.a.

*Tax deferred income reduces the cost base from $100,000 by $40,000 CGT payable is after the 50% discount and at the top tax rate of 45%.

Note: This table is for illustrative purposes only. You should seek tax advice for your personal situation.

Unlisted property trusts provide a more stable and tax-efficient investment through diversified ownership of commercial properties. As a property owner, the investor has the opportunity to participate in any capital gains on sale of the asset as well as receiving income from an income trust.

Mortgage trusts, often marketed by many issuers can carry significant risks due to how loans are originated, loan types, loan concentration and market conditions. If all goes well in a mortgage investment, the investor will receive their capital returned at the end of the term, along with income received.

While both mortgage trusts and unlisted property trusts can offer attractive returns, both differ significantly in terms of risks and benefits. It is these very features that should be scrutinised when deciding on where to invest, rather than just a headline number.

Investors should consider these factors when choosing between these investment options.

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au