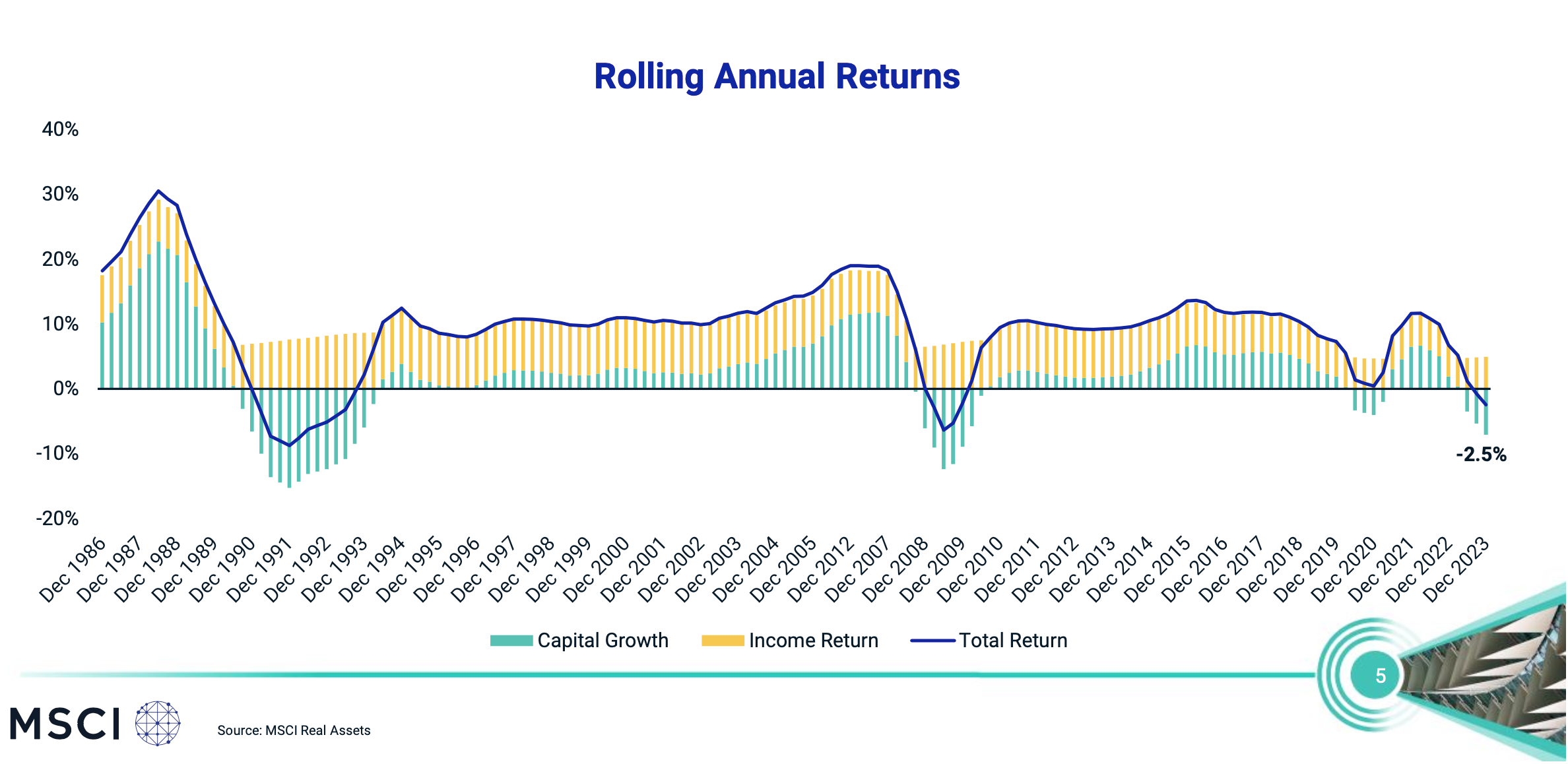

The major theme of 2025 economically has been a near obsessive focus on inflation data by the markets. It appears that every possible piece of inflation-related data has been over-analysed and markets have moved on the merest murmurings of negative news.

The result is that the expected interest rate relief did arrive, but hopes of substantial interest rate falls vanished nearly as quickly. In the end, the official rate reached 3.6% from a high of 4.35%.

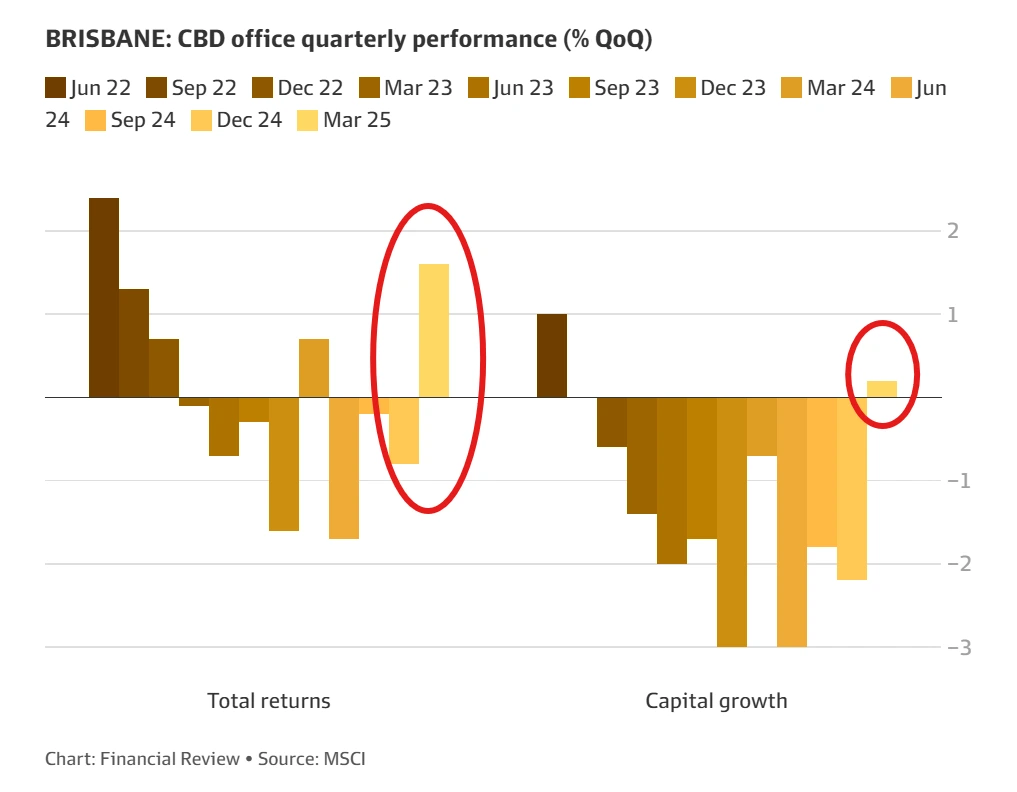

Whilst there remain some countervailing indicators, inflation remains the main act in town, in an economy which is currently showing employment resilience and little sign of housing costs easing. For property investors, these dynamics matter. Interest rates shape funding. costs, valuations, and buyer sentiment, and the rapid shifts in expectations throughout the year created an unusually noisy backdrop.

For Natgen Development Trusts, 2025 has been a year of delivery, with 5 development projects being completed during calendar 2025. This has included:

- 2 large-scale self-storage facilities at Upper Coomera and Molendinar (Natgen Development Trusts UC22 and ML23).

- 3 office/warehouse complexes, comprising a total of 60 strata title units for public sale (Natgen Development Trusts CM23, OR23 and YB24).

For the large-scale self-storage projects, each has been now refinanced into the operating let-up/operating phase.

These completions demonstrate our ability to bring projects through the full cycle and translate disciplined execution into outcomes for unitholders, with all projects tracking ahead of the return targets set out in their respective Information Memoranda.

Natgen’s investment philosophy remains grounded in three simple principles: buy well, manage well, and sell well. The past year provided opportunities to put this into practice.

Buy Well

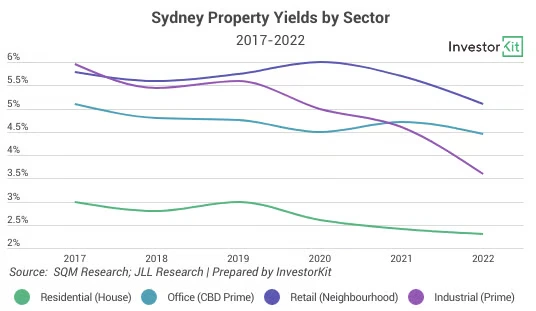

On the acquisition side, we were able to take advantage of interest rate uncertainty and secure assets CA25 (Coles-anchored shopping centre, 8% p.a. monthly distribution) and SG25 (5-star NABERs office building, 8.3% p.a. paid monthly) at material discounts to independently assessed replacement cost – a position that strengthens long-term value from day one.

Manage Well

Managing well extends beyond the property-level activity that investors typically see. It includes disciplined oversight of each Natgen Trust’s broader financial settings, with a constant eye on key expense drivers.

Throughout the year we monitored qualifying loans closely for the opportunity to either improve loan facility terms or reduce interest rate risks for the relevant trusts. Trusts GD21 and IR22 were refinanced (from CBA to ANZ) with significant reductions in the applicable margins on the debt. GL22 also benefitted from a renegotiation of the interest rate margin appliable to the loan.

This proactive approach allowed us to take advantage of diverging interest rate views and secure interest costs at or below the assumptions in our original Information Memoranda. As a result, we fixed interest rates for CO24, QC24, SP24, CA25 and SG25. The 2021 and 2022 trusts have been deliberately left on variable terms, given that these trust properties will qualify for divestment during the applicable fixed interest periods.

Also of note are new processes and personnel within the Natgen and Realtec teams to support the management function within the growing organisation. The upshot of this is improvement on the reporting structures within the management business and an ability to remain nimble and intimately connected to the assets of the size as the portfolio grows.

Sell Well

For the earlier Trusts from 2021 and 2022, we have entered the ‘pre-divestment’ phase. Our focus is on maximising the lease tenure ahead of sale – a key driver of yield compression (and in turn, higher valuations) while ensuring demonstrable cost discipline. In some cases, this involves bringing forward capital expenditure to reduce late-term expenditure on maintenance, which would otherwise affect net income for the property and detract value at sale.

These decisions were made with one objective: to provide stability, reduce risk, and underpin reliable outcomes for unitholders.

When reading my words written 12 months ago, 2025 panned out basically as expected. Whilst I was taking a conservative view on interest rate reductions, the actual results were more conservative again.

With the data we have at hand at this point, it is my personal belief that the interest rate cutting cycle is now at an end. Our in-house view is for modest interest rate increases during 2026, which is consistent with money. market movements in the past 3 months.

We will be strategically preparing for this base case. Whilst existing trusts are by and large set for the coming 3 years, this strategy is relevant for future trust offers in particular, where we are required to take a view on average interest rates over the term of the trust. We will continue to give this matter constant thought and analysis, the product of which will be apparent in future offer documents.

Other economic factors remain strong, notwithstanding blips in various measures and indices. Personally, I continue to find housing prices troubling from a general economic and social equity perspective. However, expected continuing rises in construction costs and constraints on future supply give little hope that this important national priority will improve significantly in the short to medium term.

In 2026, Natgen Investment Trust offers will continue to concentrate on income generation in a market where existing assets hold an ascendency over future assets due to the often large gap between current purchase price and replacement cost. Our traditional areas of focus will continue to be pursued, whilst new areas of focus will continue to be explored. As always, you should see little surprising from Natgen. We will provide you with updates on our areas of focus as and when they vary, and provide cogent reasoning for the change.

For Natgen Development Trusts, we will continue our active development management strategy, maintaining close cost control on construction projects and ensuring market indicators are incorporated in development appraisals and marketing plans. Additionally, we will continue the process of refining and possibly broadening our project offering to meet market expectations. For example, in the office/warehouse complex market, internal fitting standards are rising as some of these projects straddle the gap between industrial properties and lifestyle properties. This process commenced with our CM23 project at Naves Drive in Coomera, Qld, where internal bathroom, kitchen, wall covering and flooring standards were raised, with an attendant increase in sales prices and activity.

We look forward to providing you with many investment opportunities in 2026, to match with your timing and investment needs. Brett and I, and the whole Natgen team, are always very pleased to speak with our valued investors. In 2026, we will be taking a more active role in being in touch and making sure we are communicating with you as you prefer.

In closing, I would like to thank you for your support of our company. We take what we do for you very seriously – I know I always mention this, but I think it is worth reiterating. Investor value is central to every decision we make and central to our success as a business, so you have our best attention every day.

Have a fantastic Christmas and a 2026 filled with happiness, success, and Natgen.

Steven Goakes

Managing Director

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au