Natgen Managing Director, Steven Goakes explains pro’s and con’s of staying in cash when inflation is rising.

I have been asked by a number of potential investors to explain how Natgen commercial property trusts compare, when the ‘headline rate’ can seem to be comparable to bank deposit rates.

For example, currently banks are offering around 4.5% p.a. for 5 year deposits. When compared with, say, 8% from a Natgen Investment Trust, the differential does not seem so great.

In fact, comparing the two headline rates is like comparing apples with oranges.

Cash deposits have only one form of return, and that is the interest rate paid on the capital.

With Natgen Investment Trusts, investors have access to three forms of return:

- Cash income distributions;

- Taxation benefits; and

- Capital appreciation.

In our case, the ‘headline rate’ only relates to the first of these types of return.

The below example is designed to illustrate the differences between these types of investment.

Investment 1: 5 year bank term deposit @ 4.5% p.a. (return paid annually)

Investment 2: Natgen Investment Trust (return paid monthly)

Example inflation rate: 4%

Comparing Cash against a Natgen Investment Trust

* Assuming 100% tax advantaged in the 1st year. The tax not paid here will reduce the cost base of the asset for CGT purposes, therefore tax saved now will be payable as CGT upon the disposal of the units in the Trust. But, for individuals and trusts, CGT will be discounted by 50% due to the assets having been held for over 12 months. (The discount for Super Funds is 33%, and no discount for company investors.).

BUT, this is not the full story.

With the TERM DEPOSIT, you have the benefit of the government guarantee (for less than $250k deposits), in this case, you have a guarantee of a loss of $1,615.00 per annum.

With a NATGEN INVESTMENT TRUST, you have the opportunity of capital growth of the property during the term.

And whilst we hesitate to forecast capital growth for a particular asset over the particular timeframe, we do have excellent data for the past performance of commercial property across Australia for the past 40 years.

And it looks like …

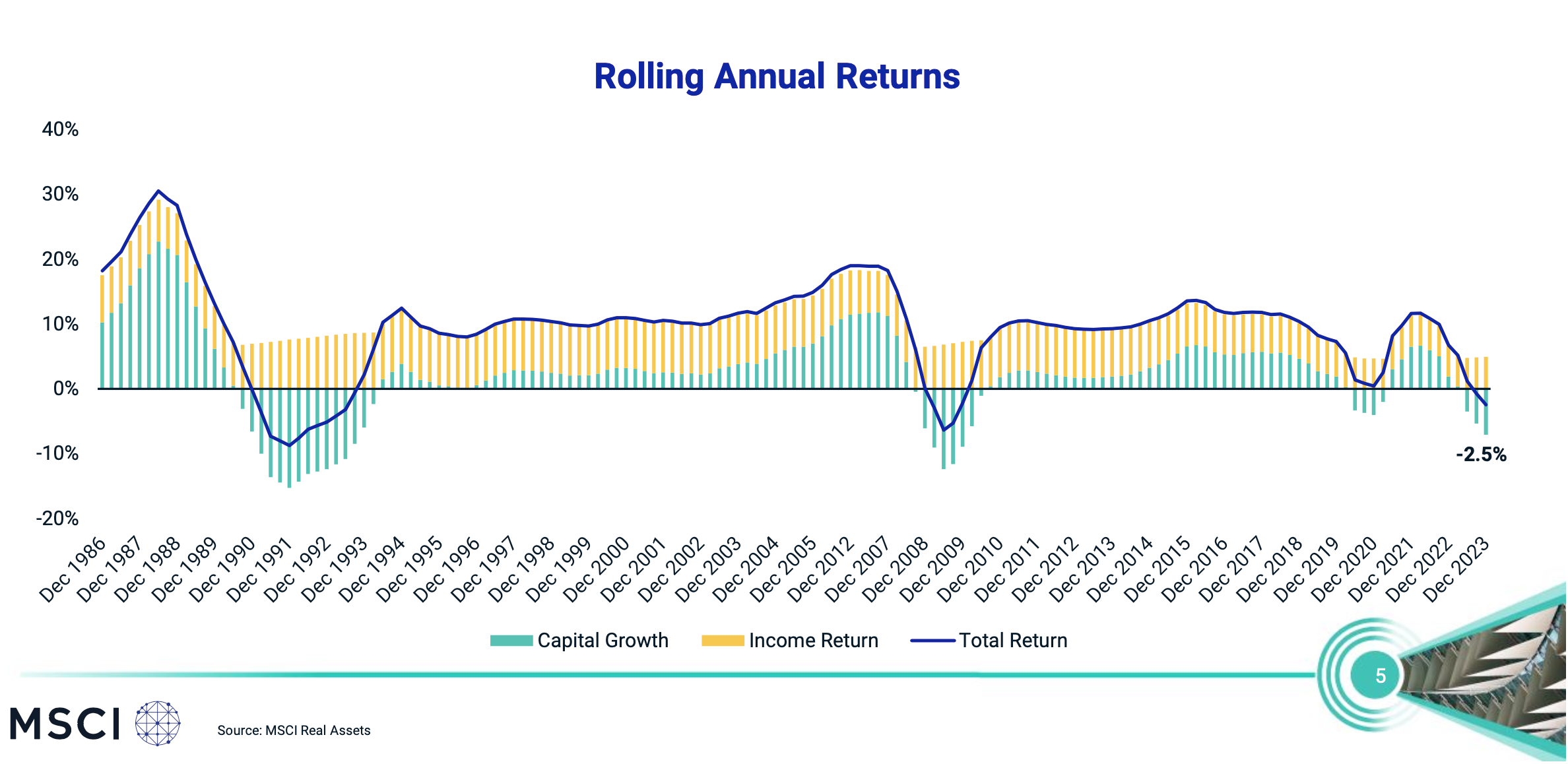

The above chart shows the consistency of income return (in yellow) from commercial property over a long time period (in this case over 35 years).

The above chart shows the consistency of income return (in yellow) from commercial property over a long time period (in this case over 35 years).

Whilst capital return shows a level of volatility, income returns are very consistent.

My observations on this graph are as follows:

- The total return over the years have been remarkably consistent and reduced or negative returns have happened sharply and recovered quickly when they have happened.

- Regardless of the level of capital returns, the income return level is very consistent and continues even when capital values fall. This indicates that holding property during these rare periods of value fall is a sound strategy for recovery in time.

- Periods of growth are much longer than periods of downturn.

Whilst we often say (correctly) that past performance is no guarantee of future performance, long term data series are valuable to isolate long term trends and value.

Capital growth potential is based on income growth potential and other measurable factors – commercial properties are often valued on the basis of the potential (and actual) rental return being achieved. Other relevant factors include economic activity, interest rates, and the commercial success of the area surrounding the property.

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au