Can my SMSF invest in a Natgen Trust?

Yes!

Many of our investors invest in Natgen Trusts via their self-managed super funds (SMSF).

Natgen Trusts acquire commercial property assets, and investors (including SMSFs) participate in our trusts to access commercial real estate assets for enhanced diversification and returns in their investment portfolios. This allows them to benefit from commercial property assets without the burden of managing them directly.Being able to invest in commercial property in your SMSF is of course dependent on a number of factors, and it is always best to check with your accountant or adviser as to your own personal situation.

How much should my SMSF invest?

Typically, SMSF’s will have an investment strategy which will act like a road map for the fund’s trustees when they decide on investments. It is there to help the fund meet its sole purpose of providing members with a retirement benefit or to their dependents should a member die before retirement.

The investment strategy may be as simple as having a certain percentage of the fund’s investment allocated to each asset class, or be more complicated and prescriptive. Ultimately, the strategy is as individual as the members of the fund and set out why and how to invest these funds to meet these goals.

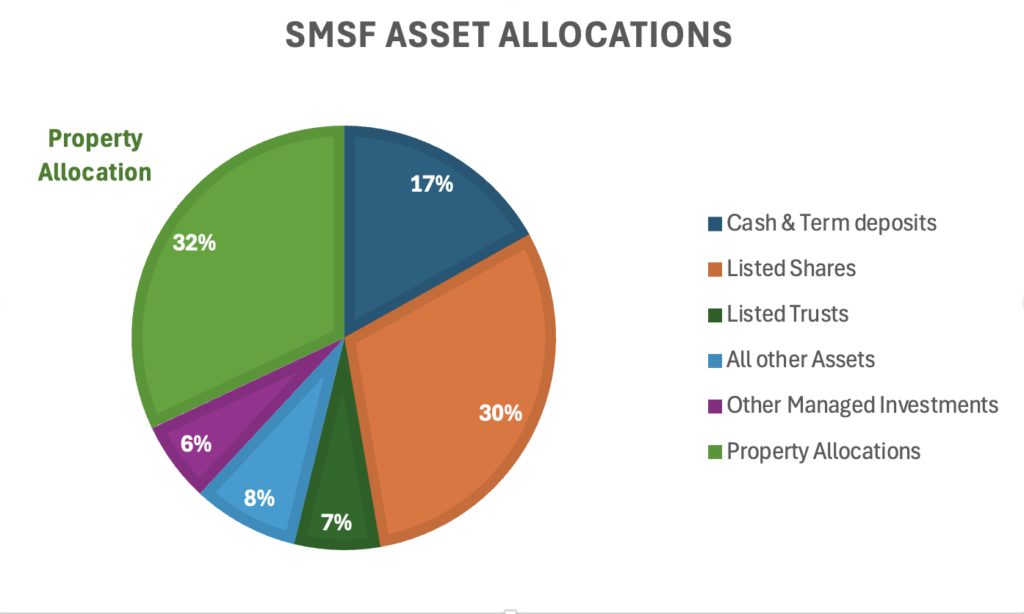

The Australian Tax Office (ATO) is the regulator for SMSFs and therefore have incredible oversight over how funds are run, and what assets they own. They published data[1] which shows that most SMSFs on average have anywhere between 20-32% allocation to property investments. This can be direct investment in residential real property, commercial real estate, limited recourse borrowing arrangements (LRBAs are specifically a structure to borrow to invest in property), or investment via unlisted trusts like the Natgen Investment Trusts.

[1] as at 30 June 2021

Commercial property assets help bring diversification to investment portfolios, and it is through diversification of asset classes and investments that help reduce risks and achieve more stable returns in the long run.

More about SMSFs

Self Managed Superannuation Fund (SMSF) Origins

Did you know that the Australian pension system is the 5th largest in the world (behind the USA, UK, Japan, & Canada), and mandated to grow by more than 11.5% p.a? Not bad for a country with a population (just under the size of the city of Shanghai) of ~26.7million and with around ~$3.8 trillion in savings.

Australians have been providing for one another since 1909 with the introduction of the publicly funded Aged Pension in 1909. But it wasn’t until Prime Minister Paul Keating enacted the Superannuation Guarantee on July 1st, 1992 which saw employers[1] contribute 4% of their employees’ wage to their superannuation account.

Since then, Australia’s retirement income system has been viewed as a model for other nations with its 3 pillar approach of;

- Publicly provided means tested age pension

- Mandatory private superannuation savings; and

- Voluntary saving (including voluntary superannuation saving)[2].

As our pension system evolved, it wasn’t until the Wallis Inquiry in 1999 which allowed small businesses and the self employed to establish and manage their own superannuation accounts – creating the very first SMSFs[3].

What is an SMSF?

A self-managed superannuation fund (SMSF) is a private fund that you can manage yourself, as distinct from an industry or retail fund where those funds choose investment and insurance options for you. But having that level of control over your own fund also comes with a number of rules and responsibilities[4] to ensure your fund meets the sole purpose test of providing retirement benefits for members.

Investment Restrictions

The Superannuation Industry (Supervision) Act 1993 (SIS Act) is the legislation outlining the various rules trustees must follow when managing an SMSF.

SMSF investments must be made on an arm’s length basis; meaning that the purchase and sale price of fund assets should always reflect the true market value, as should income from the fund assets.

There are a number of rules outlined in the SIS Act to ensure a fund meets the sole purpose test. They affect how and what your fund can investment in such as;

Related Parties and Relatives | No one associated with your fund should get a present-day benefit from its investments. |

Loans and Early Access | You can’t lend money or provide direct or indirect financial assistance from your fund to a member, or a member’s relative. |

Acquiring Assets from Related Parties | SMSF trustee is prohibited from acquiring assets from trustees of the SMSF, their relatives or related entities (except for securities listed on a prescribed exchange and business real property). |

In-House Assets | An in-house asset is a loan to, an investment in, or a lease of an asset to, a related party or entity of the SMSF. |

Business and real property | Trustees need to ensure the level of investment in business real property still meets the investment strategy of the fund, including diversification of assets, liquidity and maximisation of member returns in the fund. |

Collectible & Personal use assets | Investments in such items must be made for genuine retirement purposes, not to provide any present-day benefit. The ATO outlined how this works for jewellery, artwork and other assets. |

Borrowing | Subject to specific exception, an SMSF trustee is prohibited from borrowing or maintaining an existing borrowing of money. |

Source ATO[5]

The table above highlights some of the concepts, but of course Trustees should consult with the ATO website and their professional advisers with how this relates to their situation.

[1] Employers with an annual payroll above $1m

[2] https://treasury.gov.au/sites/default/files/2019-03/round4.pdf

[3] https://www.apra.gov.au/superannuation-australia-a-timeline#:~:text=1999,manage%20their%20own%20superannuation%20accounts.

[4] Further details on the risks and responsibilities of an SMSF are here https://moneysmart.gov.au/how-super-works/self-managed-super-fund-smsf

[5] https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/self-managed-super-funds-smsf/investing/restrictions-on-investments

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au