In August 2025, what are we seeing?

From the point of view of a keen economic observer, 2025 has so far delivered an interesting mix of stability and shocks. Many of the shocks have emanated from 1600 Pennsylvania Avenue, but these have been offset by relatively benign fundamentals and an improving interest rate environment.

Whilst AI implementation continues to be a favourite talking point for journalists and doomsayers, the general impressions across the community seem to be positive, with productivity improvements likely to flow through many industries. The employment impacts of these technologies are as yet unclear, however redeployment of labour has happened before and will, no doubt, happen again.

Since April 2025, the Australian economy has shown promising signs of recovery and growth, offering renewed optimism for commercial property market participants. Whilst some national economic issues remain very concerning, the system seems to be coping and growing moderately. Concerns include:

- lack of productivity growth within the economy;

- labour market shortages, leading to time and cost blowouts of major infrastructure projects and trickling down to the commercial projects;

- housing supply constraints, leading to increasing prices and housing stress for too many in the community; and

- overreliance on government-sourced revenue, both in business and for individuals.

As always, these matters will be addressed over time on a national level. Also as always, the response from the commercial property industry will be to deploy resources where the return on investment appears to be highest (within acceptable risk parameters).

Thus, in the long term, the market should be efficient. However it will also remain cyclical – as always.

So our primary task as participants in the commercial property investment and development market remains to constantly monitor and review the market for opportunities and long term value – as always.

The Natgen journey in 2025 so far

As outlined in my last letter, 2025 is the year when Natgen will deliver 5 development projects to the market and to investors. For updates about each development trust, please click the below link:

- Development Trust UC22

- Development Trust ML23

- Development Trust OR23

- Development Trust CM23

- Development Trust YB24

- Development Trust RY25

Additionally to these development completions, we have also released and completed three investment offers to our clients for consideration.

Natgen Investment Trust CA25 has introduced a Coles-anchored shopping centre in Cooma, NSW into the Natgen portfolio of investment trusts.

We followed this with our first foray into residential subdivision development (at least within a Natgen vehicle) with Natgen Development Trust RY25, which will develop and deliver 14 prestige small acreage housing allotments in the growth corridor between Brisbane and the Gold Coast.

Then in May 2025, Natgen Investment Trust SG25 hailed our return to the office market with an A-grade office building purchase in the tightly-held Cannon Hill office precinct in Brisbane. This purchase is designed to leverage the current position of the office market at ‘bottom of cycle’ and to provide market-driven growth opportunities.

What’s next?

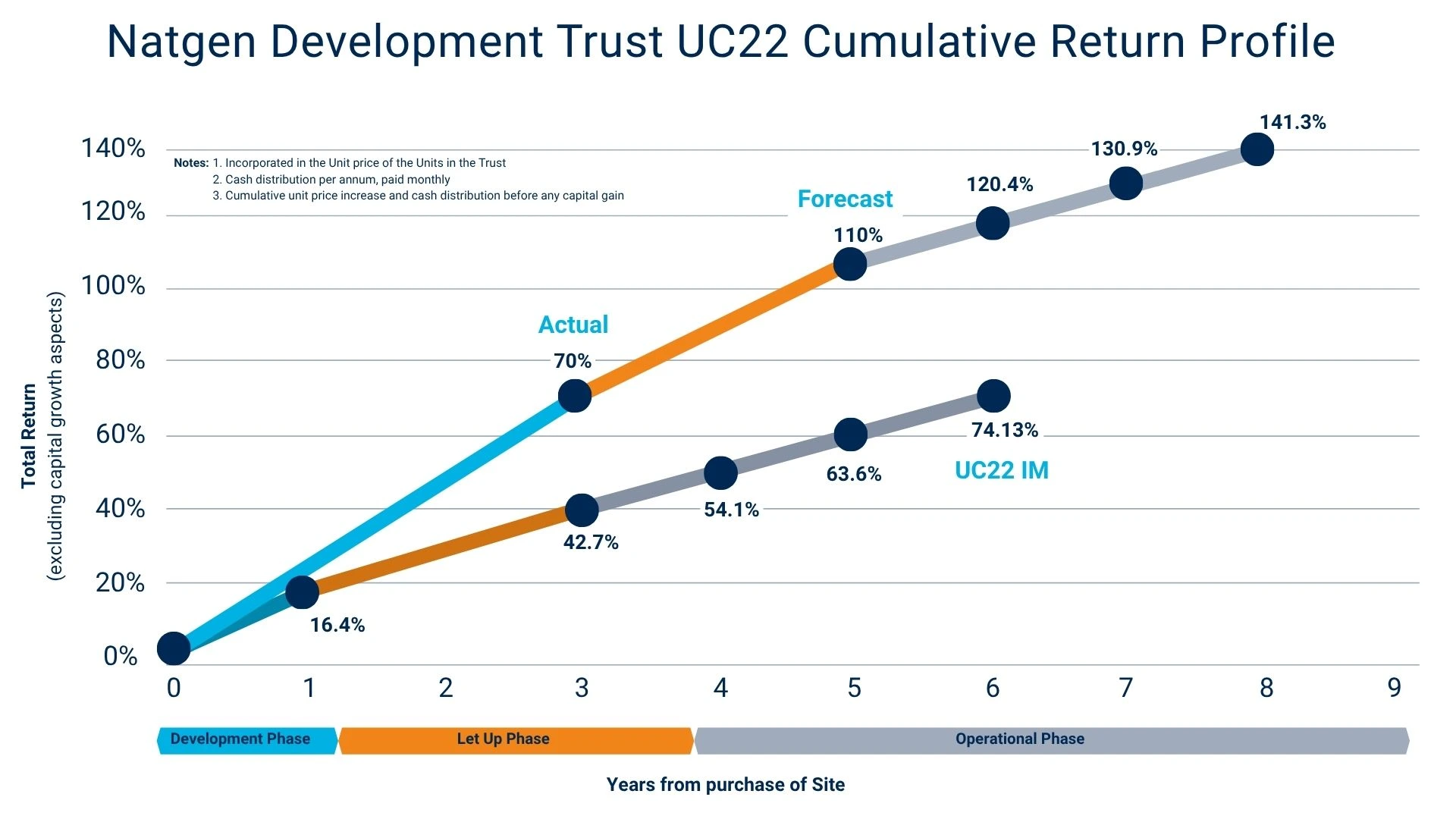

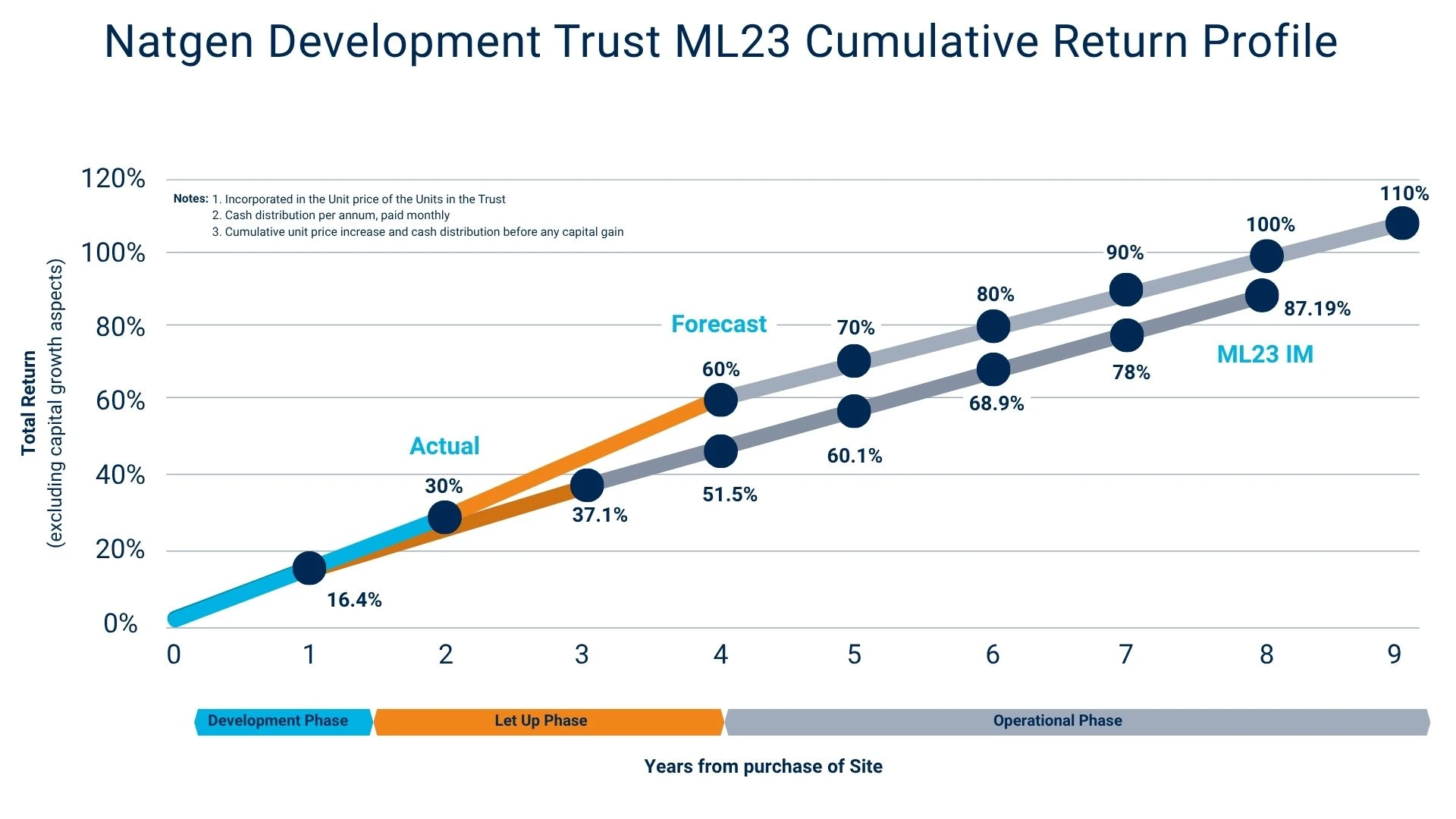

The second half of 2025 will initially provide a further focus on development. Our expectation in that our next longer-term self-storage development will be launched in the coming weeks. This comes immediately following the revaluation and refinance of the previous self-storage projects being Natgen Development Trusts UC22 and ML23.

The following graphs indicate the trajectory of the growth in unit value of the two projects compared to Information Memorandum forecasts.

General Self Storage

A product of these self-storage investments has been the creation of the General Self Storage brand to operate the facilities for the Trusts. General Self Storage has been formed by Natgen to provide operating services for the self-storage facilities at a significantly lower cost than alternative operators in the self-storage industry. We believe that this will provide a valuable and sustained advantage to our unitholders, whilst maintaining flexibility to allow for divestment of the facilities when market opportunities arise.

These are excellent results for both trusts and provide a solid basis for the next phases of these projects and to future self-storage projects.

Time for Re-financing

As always, Natgen has been maintaining a watch on the debt markets with a view to improving the position of our Trusts in terms of debt terms and interest rates.

We made the decision to seek refinancing of the assets of Natgen Investment Trusts GD21 and IR22 in the middle of the year. I am pleased to advise that the refinancing of these two trusts has now been completed, with achieved margins of at least 0.5% per annum lower interest rate margin in each case. These refinances were underpinned by asset revaluations which raised the value of each centre by at least 10%, allowing the previous 55% loan to valuation ratios for these assets to be reduced to 50% or less.

This is a good indication of the active management strategy of Natgen Investment Trusts extending to the capital management of the Trusts.

Future Acquisitions

The Natgen Investment Philosophy remains the basis of our acquisitions activities. We constantly seek mispriced assets in our areas and sectors of interest.

I hope that over time you can pick the cohesion of our strategy. A Natgen offer should never be a great surprise, because our areas of focus should have been well communicated to you in advance.

The rest of 2025 and the beginning of 2026 promise to be very busy and intense times at Natgen, and I look forward to sharing this journey with you in my future letters. In the meantime, best wishes for the remainder of 2025.

Sincerely,

Steven Goakes

Managing Director

Natgen

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au