Super Changes: What does the proposed $3M super tax mean for SMSF investors?

The new financial year ushers in with it the proposed Division 296 tax on superannuation, or the so-called “$3 million super tax on unrealised profits”.

It has attracted plenty of attention from the media, as it controversially proposes to tax unrealised gains, and all on imperfect information.

We have received a number of enquiries from investors, and have prepared the following note in consultation with Natgen aligned accountant groups.

Important Notes

The following note is information only and not financial advice. If you have further queries, we recommend you seek further advice to your personal situation.

Secondly, you should be aware this legislation is not yet law. While the proposal has been drafted and is expected to be retrospective to 1 July 2025, it is still subject to amendment and being passed by Parliament.

What is being proposed?

- Super balances above $3 million will attract an additional 15% tax on earnings above the $3 million cap – i.e. not the entire balance.

- The calculation is based on movements in your total super balance, including unrealised gains (even if the asset is not sold)1.

- It is calculated per individual, not per SMSF.

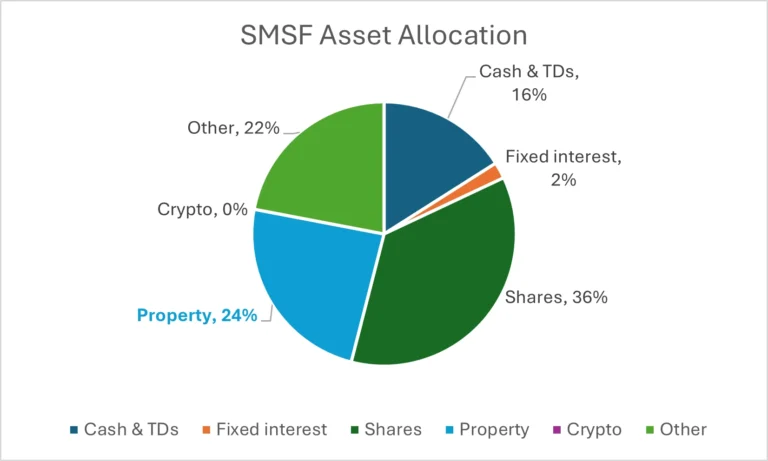

Types of assets held in SMSFs

Historically, superannuation has long been considered the appropriate investment vehicle for growth assets in due to concessional tax arrangements. However, the proposed Division 296 tax changes have upended this, and in discussions with trusted accountants we unpack some client discussions.

1 Capital gains (assuming assets are held for greater than 12 months) are likely to be taxed at 25% (where 10% fund tax rate on realisation after applying the available discount and the 15% new tax rate on unrealised gains while the asset is held by the SMSF)

Natgen’s Head of Funds Management Peta Tilse says “A key consideration is the effect of growth, or income-oriented assets held within super under a Division 296 regime. Accountants have different approaches – but what seems consistent is growth-oriented investments are now less appealing to those close to or above the $3 million threshold”.

Instead, income assets with some capital gain will be preferred investment attributes. With SMSF’s typically holding over 1/3 of investments in growth-oriented shares, it is likely this allocation will be rebalanced.

Low volatility the new preference

Assets with higher volatility like listed shares, ETFs, or cryptocurrencies can produce temporary spikes in super balances, potentially triggering tax liabilities on gains that may not be realised (or could quickly reverse).

In contrast, low volatility and income-based investments such as unlisted property trusts like Natgen Investment Trusts offer some natural insulation. Natgen Investment Trusts are typically structured with:

- Stable valuations, supported by an annual independent director’s valuation.

- A model based on cash earnings distributed monthly, meaning unit prices generally hover around $1 throughout the investment term.

- Minimum investment size of $100,000 – allow greater diversification and liquidity planning for investors

- Less volatility than listed markets, reducing the risk of short-term valuation swings triggering unexpected tax liabilities.

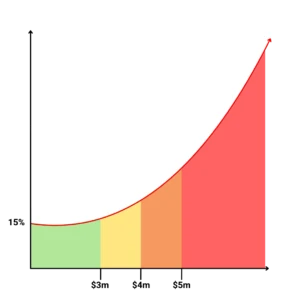

How Significant is the Tax?

Whether you speak to your accountant or not, industry groups like the SMSF Association and ASFA have published a lot of information about the application and calculation. What is evident, is for individuals with balances at or around $3 million, the tax payable could be anywhere from several hundreds of dollars to say $20,000. It is the individuals with balances upward of $4 million that will question tax management strategies.

It is also important to remember that the underlying income from property investments can help fund any future tax liability, without the need to sell assets.

Our View

While the Division 296 tax may create some change for certain investors, superannuation remains one of the most tax-effective wealth vehicles available – but to a point.

With imperfect information, we encourage you to speak with your accountant or adviser to understand the implications for your individual circumstances.

If you’d like to discuss how our commercial property funds continue to support the needs of SMSF investors particularly those seeking stable income and lower volatility our team is happy to assist.

For further details on the proposed changes, the following resources may be helpful:

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au