Top 8 Benefits of Commercial Investment Vs Residential Investment

When most people think of property investment, they think of ‘negative gearing’ a residential home or apartment. Many are unaware that commercial property investment trusts provide an alternative property investment option for similar investment amounts.

Natgen’s managing director, Steven Goakes, discusses this topic further.

There are a number of key differences between residential and commercial property investments which can be categorised as follows.

1. Types of tenants:

Commercial tenancies are leased to businesses, whereas residential properties are leased to individuals or families. This is a key difference, because the business lessee relies upon the commercial premises to general income for the business. This, in turn, often means that commercial tenants look after the premises better and have a vested interest in maintaining the property in good condition. this cannot be assured for residential tenants.

2. Lease terms and conditions:

Commercial leases tend to be for significantly longer periods (often between 5 and 10 years) and have more complex terms and conditions. They typically include provisions for rental increases annually, tenant improvements and maintenance and options to renew. Residential leases, on the other hand are usually for much shorter terms (often 6 to 12 months) and other conditions are limited by residential tenancy legislation.

3. Rental income:

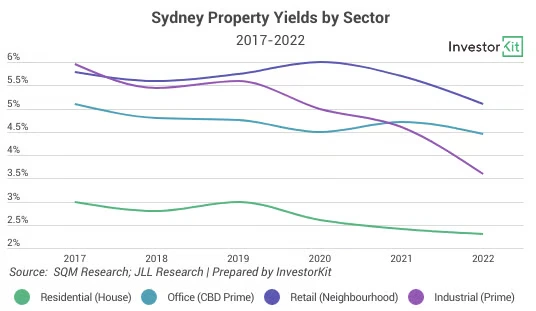

Commercial properties typically generate higher returns than residential properties, due to the specialty of the asset for the intended tenant and the relative cost of provision of commercial space. Whilst commercial properties tend to have higher operating costs, these are usually reflected in the rent or by specific outgoing payments to the landlord.

4. Capital appreciation:

The increase in the value of commercial properties is largely insulated from general real estate market sentiment, which by and large drives the residential property market. The principle determinant of the capital value of a commercial property is the net income return from the property, which will be multiplied by a rental yield factor which takes into account the risks associated to that income stream. Residential property prices are more directly impacted in changes in sentiment relating to economic conditions and factors such as interest rate movements. Also, given the lower income returns available from residential investors is more reliant on capital growth for an investment return whereas a higher proportion of the commercial investor returns is drawn from annual income.

5. Risk:

Whilst risk factors apply to both residential and commercial properties, the drivers of the risk profile to differ. The steady nature of the income streams available from commercial properties tend to reduce the volatility (a.k.a risk) of the returns available in this market as compared with the residential market.

6. Taxation:

The taxation treatment of commercial and residential property can differ significantly, with differing depreciation rates often applying to differing property types. We consider the taxation treatment of commercial properties to be particularly beneficial to the investor in the long term, with the capital gain proportion of the total return from the property being taxed and concessional rates, which vary depending on the type of investor entity involved.

7. Management:

In the commercial property sphere, the quality of the management of a building can make an enormous difference to the experience of the tenants and thus to the long term income potential of the property. Thus skilled, focussed management is a very important aspect of commercial property ownership. In the residential sphere, property management is less important, as it tends to be less impactful to the performance of the property.

8. Financing and capital management:

Commercial properties are debt financed on a different basis to residential properties, with debt capital typically coming to the commercial debt market rather than the more highly regulated residential debt market. This provides a broader range of debt options for commercial property ownership, albeit with a wider range of interest rates applicable to the various options.

Negative gearing in residential property – is it the Holy Grail?

When most people think of property investment, they tend to think of ‘negative gearing’ a residential home or apartment. The ‘negative gearing industry’ has been relentlessly promoting this for many years, and their messages are well known.

Of course, negative gearing involves losing money on your investment property (i.e. negative

annual profit) in order to minimise tax on income derived from other sources. Then, the investor hopes that the asset’s value grows to eventually give an overall positive return. This ‘lose money to make money’ proposition makes some sense in a strongly growing market but can be a disaster in a moderate market.

As an alternative, commercial property investment exhibits some fundamental differences.

To begin with, commercial property investments are generally structured to be positively

geared – you make an income return on your investment funds year after year even after interest costs, meaning that you are less reliant on capita l growth to produce a total return overtime.

For my money, I much prefer to make regular positive returns as my investment progresses.

After all, a bird in the hand is worth two in the bush!

Natgen provides clients with well-considered, carefully measured commercial investment opportunities, accompanied by professional advice from our experienced leaders.

If you’d like to be notified of future investment opportunities, request an Investor Information Pack or contact us directly at invest@natgen.com.au